Who Has the Cheapest Car Insurance Quotes in Washington, DC? (2024)

Geico has the best cheap car insurance in Washington, D.C., at $136 per month for full coverage.

Find Cheap Auto Insurance Quotes in Washington, D.C.

Best cheap car insurance companies in DC

How we chose the top companies

Best and cheapest car insurance in Washington, D.C.

- Cheapest full coverage: Geico, $136/mo

- Cheapest minimum liability: Geico, $55/mo

- Cheapest for young drivers: Erie, $305/mo

- Cheapest after a ticket: Erie, $156/mo

- Cheapest after an accident: Erie, $188/mo

- Cheapest for teens after a ticket: Erie, $143/mo

- Cheapest after a DUI: Progressive, $205/mo

- Cheapest for poor credit: Geico, $311/mo

Monthly rates based on full coverage car insurance for a 30-year-old man. Some rates use different ages or coverage limits.

Erie has the best mix of reliable customer service and cheap quotes in Washington, D.C.

Although Geico and Progressive have cheaper rates for some people, their customer service isn't typically as good as Erie.

Cheapest car insurance in Washington, D.C.: Geico

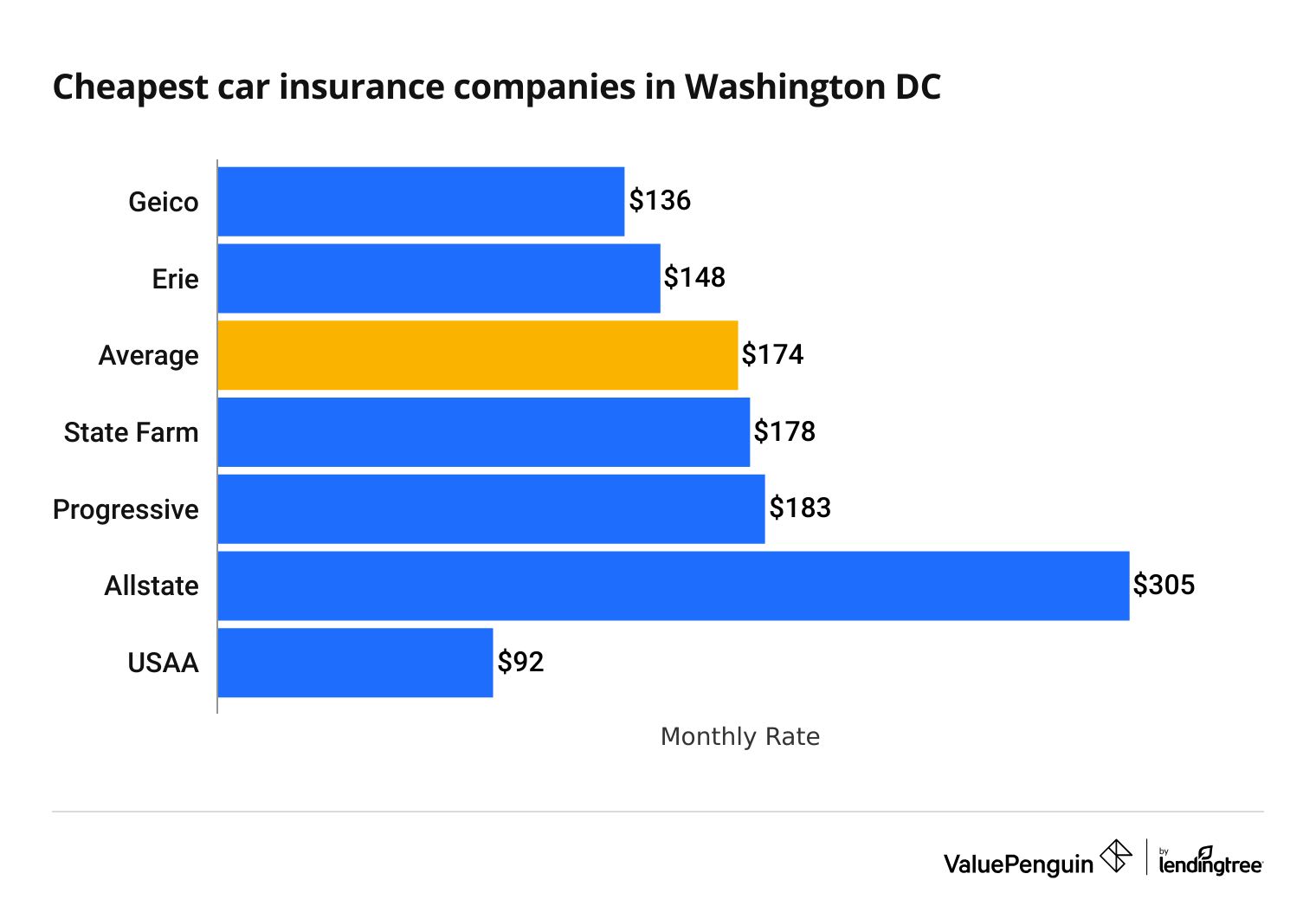

Geico has the most affordable full coverage auto insurance in D.C. At $136 per month, coverage from Geico is $38 less per month than the city average.

The average cost of a full coverage auto insurance policy in the nation's capital is $174 per month, or $2,082 per year.

Find Cheap Auto Insurance Quotes in Washington, D.C.

USAA offers the cheapest quotes overall, but policies are only available to current or former military members and their families.

Cheapest D.C. car insurance for full coverage

Company | Monthly rate | |

|---|---|---|

| Geico | $136 | |

| Erie | $148 | |

| State Farm | $178 | |

| Progressive | $183 | |

| Allstate | $305 |

*USAA is only available to current and former military members and their families.

Cheapest liability insurance quotes in Washington, D.C.: Geico

Geico has the cheapest minimum coverage car insurance quotes in Washington, D.C. A policy from Geico costs $55 per month, which is 31% cheaper than average.

The average cost of car insurance in Washington, D.C., is $79 per month, or $949 per year, for a minimum coverage policy.

Cheapest D.C. car insurance companies

Company | Monthly rate |

|---|---|

| Geico | $55 |

| Erie | $55 |

| State Farm | $77 |

| Progressive | $103 |

| Allstate | $142 |

*USAA is only available to current and former military members and their families.

Find Cheap Auto Insurance Quotes in Washington, D.C.

Cheapest D.C. car insurance quotes for young drivers: Erie

Erie has the cheapest quotes for teenage drivers in Washington, D.C.

Minimum coverage insurance for young drivers from Erie costs $110 per month, which is $181 less per month than the D.C. average. Erie also offers the best rates for full coverage, at $305 per month — $309 per month cheaper than average.

The average minimum coverage quote for an 18-year-old driver in Washington, D.C., is $291 per month. That's more than three times the rate for a 30-year-old driver. Full coverage for a young driver averages $614 per month.

Cheapest D.C. car insurance companies for teens

Company | Liability only | Full coverage |

|---|---|---|

| Erie | $110 | $305 |

| Geico | $167 | $398 |

| State Farm | $245 | $576 |

| Allstate | $502 | $1,067 |

| Progressive | $627 | $1,135 |

Insurance companies consider younger drivers high-risk due to their lack of driving experience, so these drivers tend to pay more for insurance.

Young drivers can save on insurance by looking for discounts for good grades, safe driving or leaving their car at home while away at school.

New drivers can also save by joining a parent's car insurance policy, which can lower the cost of car insurance by 62%.

Cheapest car insurance after a speeding ticket: Erie

Erie has the cheapest car insurance quotes for Washington, D.C., drivers with a single speeding ticket. Full coverage insurance from Erie is $156 per month after a ticket. That's 23% less than the city average, and $17 per month cheaper than the second-cheapest option, Geico.

Company | Monthly rate |

|---|---|

| Erie | $156 |

| Geico | $173 |

| State Farm | $192 |

| Progressive | $227 |

| Allstate | $353 |

A single speeding ticket raises rates by $28 per month in Washington, D.C. — a 17% increase.

Cheapest car insurance in D.C. after an accident: Erie

Erie has the best car insurance quotes for D.C. drivers with an at-fault accident on their driving record. At $188 per month, a full coverage policy from Erie is 25% cheaper than average.

Company | Monthly rate |

|---|---|

| Erie | $188 |

| State Farm | $209 |

| Geico | $268 |

| Progressive | $279 |

| Allstate | $424 |

Just one at-fault accident on your driving record can increase your car insurance quotes by 44% in Washington, D.C.

Cheap car insurance for teen drivers after a ticket or accident: Erie

Erie has the most affordable car insurance for young drivers with a speeding ticket or accident on their record.

Minimum coverage from Erie costs an average of $143 per month for an 18-year-old driver after a single speeding ticket. Young drivers with an at-fault accident on their record pay around $126 per month for minimum coverage with Erie.

Company | Ticket | Accident |

|---|---|---|

| Erie | $143 | $126 |

| Geico | $187 | $246 |

| State Farm | $266 | $292 |

| Allstate | $586 | $594 |

| Progressive | $659 | $707 |

On average, insurance companies raise rates for teen drivers in D.C. by 12% after a speeding ticket and 19% after an accident.

Cheapest car insurance quotes after a DUI: Progressive

Progressive offers the best rates in Washington, D.C., for drivers with a DUI (driving under the influence) conviction.

The company's average rate for full coverage after a DUI is $205 per month. That's $16 per month cheaper than the next-cheapest company, Erie.

Company | Monthly rate |

|---|---|

| Progressive | $205 |

| Erie | $221 |

| Geico | $313 |

| Allstate | $391 |

| State Farm | $477 |

Overall, D.C. drivers pay 70% more after a DUI, an increase of $121 per month. These drivers may also have to get SR-22 insurance, which can make insurance rates even more expensive.

Cheapest car insurance for drivers with poor credit: Geico

Geico has the best quotes for Washington, D.C., drivers with bad credit. The company's average rate for full coverage is $311 per month, which is 33% cheaper than average in D.C.

Company | Monthly rate |

|---|---|

| Geico | $311 |

| Progressive | $366 |

| Erie | $387 |

| Allstate | $499 |

| State Farm | $1,035 |

Poor credit more than doubles rates for Washington, D.C., drivers. Although your credit is not connected to your driving ability or record, insurance companies have found drivers with poor credit are more likely to make claims in the future.

Best car insurance companies in Washington, D.C.

USAA offers the best car insurance in D.C. because of its dependable customer service, useful coverage options and affordable quotes.

Although USAA earned the highest customer service scores from our editors and J.D. Power, it's only available to military members, veterans and their families. Drivers in Washington, D.C., can also find great service at State Farm and Erie.

Best car insurance

Company |

Editor's rating

|

J.D. Power

|

AM Best

|

|---|---|---|---|

| USAA | 881 | A++ | |

| Erie | 871 | A+ | |

| State Farm | 842 | A++ | |

| Geico | 835 | A++ | |

| Allstate | 824 | A+ |

When shopping for car insurance in Washington, D.C., choosing a company with a reputation for great service is just as important as finding the cheapest rates.

If you're in an accident, reliable customer service can make the claims process less stressful and get you back on the road quickly. Companies with poor reviews could have a longer claims process, and you may end up paying more out of pocket to repair your car.

Average car insurance costs in the D.C. metro area

D.C.'s auto insurance quotes are some of the cheaper rates in the metropolitan area.

Virginia suburbs Burke and Springfield, meanwhile, are the most expensive areas for full coverage insurance in the region.

The District of Columbia packs more than 700,000 people into 69 square miles and is surrounded by a metropolitan area of 5.4 million. And just as the overall cost of living in Washington, D.C., is well above the national average, so too is the cost of car insurance, both in the District and in neighboring communities.

City | Monthly rate |

|---|---|

| Bethesda, MD | $154 |

| Potomac, MD | $161 |

| Rockville, MD | $167 |

| Gaithersburg, MD | $170 |

| Ellicott City, MD | $172 |

Auto insurance requirements in D.C.

Drivers are required to buy a minimum amount of bodily injury and property damage liability car insurance coverage in Washington, D.C., sometimes written as 25/50/10. Drivers also have to have matching uninsured/underinsured motorist bodily injury coverage and $5,000 of uninsured motorist property damage.

Coverage | Limit |

|---|---|

| Bodily injury (BI) liability | $25,000 per person and $50,000 per accident |

| Property damage (PD) liability | $10,000 per accident |

| Uninsured motorist bodily injury (UMBI) | $25,000 per person and $50,000 per accident |

| Uninsured motorist property damage (UMPD) | $5,000 per accident; $200 deductible |

However, most drivers should consider adding higher coverage limits to pay for damage after an expensive accident.

What's the best car insurance coverage for D.C. drivers?

Liability-only policies cover injuries to the other driver and damage to their car after an accident you cause. Unlike full coverage quotes, minimum coverage quotes don't include comprehensive and collision insurance, which protect your car from damage after a crash, theft, vandalism or a weather event — regardless of whose fault it is.

While full coverage generally costs more, choosing higher liability limits and adding comprehensive and collision coverage can help protect you after an expensive accident. It's also required if you have a car loan or lease.

The average cost difference between full and minimum coverage car insurance in D.C. is $95 per month.

Frequently asked questions

Who has the cheapest car insurance in Washington, D.C.?

Geico offers the cheapest auto insurance quotes in Washington, D.C., averaging $55 per month for minimum coverage and $136 per month for full coverage.

How much is car insurance in Washington, D.C.?

Minimum coverage car insurance costs an average of $79 per month in Washington, D.C., while full coverage is $174 per month.

Who has the best auto insurance in Washington, D.C.?

USAA has the best car insurance in D.C. for eligible drivers, based on its reputation for dependable customer service, affordable rates and coverage availability. Drivers in D.C. who don't qualify for USAA can also get great service from Erie and State Farm.

Is car insurance high in D.C.?

The average cost of car insurance in D.C. is more expensive than in most states in the country. A minimum coverage policy costs $79 per month, which is 23% higher than the nation's average. Washington, D.C., car insurance is expensive partly because of the high population density and traffic congestion.

Do you need car insurance in D.C.?

Drivers in Washington, D.C., are required to have car insurance that includes $25,000 in bodily injury coverage per person and $50,000 per accident, as well as matching uninsured motorist coverage. Drivers also have to get $10,000 in property damage coverage and $5,000 of uninsured motorist property damage per accident.

Is car insurance cheaper in D.C. or Baltimore?

The average price of car insurance is considerably cheaper in Washington, D.C., than it is in Baltimore. The average quote for full coverage in D.C. is $174 per month, compared to $250 per month in Baltimore.

Methodology

ValuePenguin collected auto insurance quotes for Washington, D.C., from top car insurance companies in the area. Rates, except where noted, are for a 30-year-old man with good credit who drives a 2015 Honda Civic EX.

Unless otherwise noted, rates are based on full coverage insurance. Full coverage policies included liability limits higher than required minimums plus collision and comprehensive coverage.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Personal injury protection: $10,000

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury: $50,000 per person and $100,000 per accident

- Uninsured and underinsured motorist property damage: $5,000 per accident; $200 deductible

- Comprehensive and collision: $500 deductible

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.