The Cheapest (and Best) Full Coverage Car Insurance of 2024

State Farm has the cheapest full coverage auto insurance for most drivers, at $124 per month, on average.

Find Cheap Auto Insurance Quotes in Your Area

Cheapest full coverage insurance companies

-

Full coverage$1,000/moRate for a 30-year-old

-

Liability$800/moRate for a 30-year-old

-

Monthly rate$12Rate for a 30-year-old

ValuePenguin gathered millions of quotes from across every ZIP code in the U.S. for a 30-year-old driver with a 2015 Honda Civic EX and a clean driving record.

The best companies for full coverage auto insurance have affordable rates and good customer service scores. Full methodology.

How to get cheap full coverage car insurance

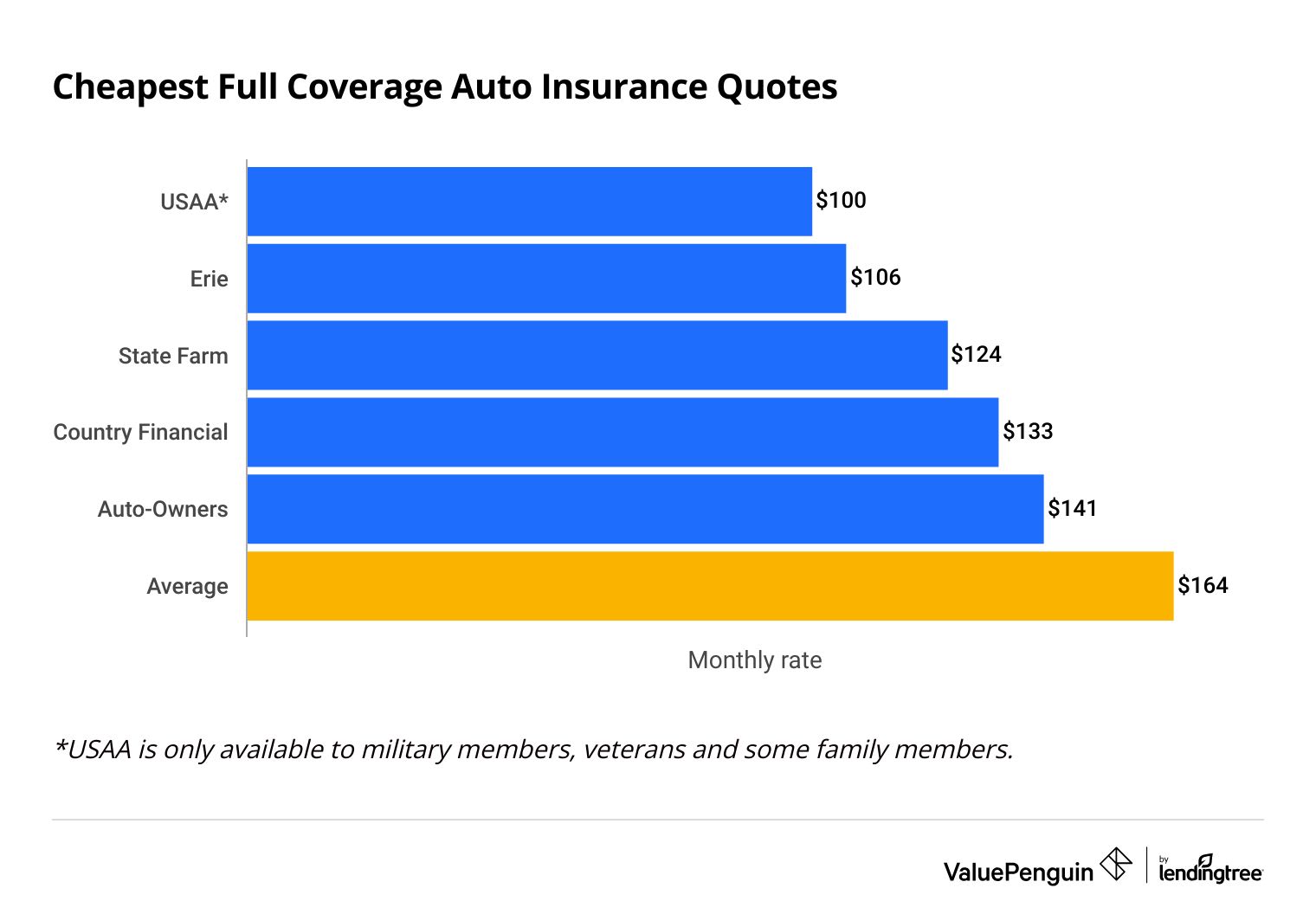

State Farm, Erie and USAA have the best cheap full coverage quotes.

At $124 per month, State Farm has the best cheap full coverage insurance for most drivers.

Find the Cheapest Full Coverage Quotes in Your Area

Erie and USAA are cheaper than State Farm. However, you can only get Erie car insurance in 12 states and Washington, D.C. And USAA is only available to military members, veterans and their families. But it's worth getting quotes from either company if you're able.

Cheap full coverage car insurance

Company | Monthly rate | ||

|---|---|---|---|

| Erie | $106 | ||

| State Farm | $124 | ||

| Country Financial | $133 | ||

| Auto-Owners | $141 | ||

| American Family | $160 | ||

*Only current and former military members and their families are eligible for a USAA policy.

The average cost of full coverage car insurance is $164 per month.

That's more than twice the average price of liability-only car insurance.

Full coverage is more expensive because it includes collision and comprehensive coverage along with liability. So your insurance company will pay to fix damage to your car after a covered accident, like if you hit another car or a tree limb falls on your vehicle.

Best affordable full coverage car insurance for most people: State Farm

-

Editor's rating

- Full coverage: $124/mo

Pros:

-

Cheapest national insurance company

Reliable customer service

Cons:

-

Missing optional coverages like gap insurance and accident forgiveness

State Farm is the cheapest insurance company available to almost all drivers across the country.

Full coverage from State Farm is $40/mo cheaper than average

Helpful customer service after a crash

Great for bundling with home insurance, renters insurance and more

State Farm is the largest car insurance company in the United States. It typically has cheaper quotes than most other large companies and many regional companies.

State Farm also has a good reputation for reliable customer service. State Farm customers tend to have fewer complaints and are happy with the claims process, according to J.D. Power.

Cheapest local company for full coverage auto insurance: Erie

-

Editor's rating

- Full coverage: $106/mo

Pros:

-

Very affordable full coverage insurance

-

Excellent customer service

Cons:

-

Only available in 12 states and D.C.

-

Must buy a policy through an agent

Erie has some of the cheapest full coverage rates in the country, along with an excellent customer service reputation.

Full coverage from Erie is $58 cheaper than average

Exceptional claims experience after a crash

Lots of options to customize your policy with extra protection

Great for bundling with home and renters insurance policies

Erie is a very good company with affordable full coverage auto insurance rates and exceptional customer service.

Drivers can count on Erie to get their car fixed quickly after a crash. It earned second place on J.D. Power's claims satisfaction survey. That means customers are typically happy with the claims process at Erie.

However, Erie is only available in 12 states, mostly on the East Coast and in the Midwest. And you'll have to call an agent to buy a policy from Erie.

Cheapest full coverage car insurance for military families: USAA

-

Editor's rating

- Full coverage: $100/mo

Pros:

-

Low-cost full coverage auto insurance

-

Great customer service

Cons:

-

Only available to military members, veterans and some of their family members

USAA is one of the best car insurance companies in the country for affordable quotes and great support.

Full coverage car insurance is $64/mo cheaper than average

Lots of discounts, including military-specific savings

Great for bundling multiple types of insurance policies

At $100 per month, USAA has the cheapest full coverage policies in the country. And it consistently ranks as one of the best companies for customer satisfaction, according to J.D. Power.

However, USAA only sells car insurance to military members, veterans and their families. This means most drivers can’t buy a policy from USAA.

Best basic full coverage auto insurance: Country Financial

-

Editor's rating

- Full coverage: $133/mo

Pros:

-

Low-cost full coverage car insurance

-

Lots of discounts

Cons:

-

Few ways to personalize your coverage

Country Financial is a great option for full coverage car insurance if you don't need lots of coverage add-ons, like gap insurance.

Full coverage costs $31/mo less than average

Reliable customer service after an accident

Lots of discounts to help you save on full coverage

Country Financial is a great option for drivers looking for cheap rates and basic protection. At $133 per month, full coverage from Country Financial costs 19% less than the national average.

However, it only offers a few coverage add-ons, like roadside assistance. It's not the best choice for people who want gap insurance, accident forgiveness and other added protection.

The company also has a reputation for excellent service after an accident. It earned a very high score on J.D. Power's claims satisfaction survey, which means you can count on Country Financial to have a quick and easy claims process after a crash.

Cheapest company for extra car insurance coverage: Auto-Owners

-

Editor's rating

- Full coverage: $141/mo

Pros:

-

Lots of ways to personalize your policy

-

Great discounts for teen drivers

Cons:

-

Only available in 26 states

Auto-Owners has the best full coverage auto insurance for drivers who need extra protection.

Full coverage is $23/mo cheaper than average

Lots of coverage add-ons for extra protection

Cheap rates and numerous discounts for families with teens

Dependable customer service

Drivers who need extra coverage should consider buying full coverage car insurance from Auto-Owners.

You can pay to add coverage that you won't find with every company, like gap coverage and accident forgiveness.

However, Auto-Owners is only available in 26 states. If you need extra protection but can't get Auto-Owners insurance, you should consider Travelers.

Cheap full coverage car insurance by state

Full coverage car insurance quotes can vary by more than $600 per month, depending on which state you live in and which company you choose.

State Farm has the cheapest full coverage insurance in 25 states.

Geico is the cheapest company in seven states, and Erie has the most affordable full coverage in four states.

Drivers with military ties can often find the lowest rates with USAA. It's the cheapest option in many states, but it's only available to military members, veterans and their families.

Cheapest full coverage car insurance company in each state

State | Company | Monthly rate |

|---|---|---|

| Alabama | State Farm | $85 |

| Alaska | Geico | $112 |

| Arizona | State Farm | $125 |

| Arkansas | State Farm | $101 |

| California | Geico | $124 |

How to compare cheap full coverage insurance

- Shop around to see if you can find cheaper full coverage quotes from a different company.

- Get rid of coverage you don't need. You'll get less protection, but the trade-off may be worth it for you.

How to get full coverage insurance quotes

Comparison shopping helps you find which insurance company has the best rates for you.

- Compare the same coverage limits and add-ons with each company. That way, you're making an apples-to-apples price comparison.

- Choose the same deductible. Increasing your deductible lowers the cost of your policy and can change the quotes you get.

- Get quotes from multiple companies. Different insurance companies might offer the same coverage for different prices. You could find inexpensive full coverage rates from a different company than friends or neighbors.

How to save on full coverage car insurance

One way to lower your insurance rates is by reducing your coverage.

- Increase your deductible. If you increase your deductible, you'll get less money from your insurance company for a claim. But, you'll pay a lower monthly rate. You should compare the cost of insurance with different deductibles to see whether the monthly savings are worth the reduced payout after a crash.

- Lower limits for liability and other coverage. Remember that lower liability limits may not be enough to pay for damages if you cause an expensive accident.

- Remove coverage add-ons you don't need. For example, if you can easily get around town using public transportation or have a second car, you may not need rental car reimbursement.

You can also save money by qualifying for car insurance discounts, like safe driving or automatic payment discounts.

Is full coverage the best car insurance?

Full coverage is the best choice for most drivers, especially if you have a newer or financed car.

Full coverage costs twice as much as minimum coverage because it pays for damage to your car in most types of accidents.

That's because full coverage comes with collision and comprehensive coverage. It's also why your lender probably requires full coverage if you have a leased or financed car.

In comparison, a minimum liability policy only covers injuries to others and damage to their car or property.

In addition to protecting your car, full coverage typically includes higher liability limits than minimum coverage.

Many states require very low liability limits that don't provide enough protection to cover the cost of a major accident. The higher limits included with full coverage mean you'll pay less out of pocket if you cause a major accident.

What's included with full coverage car insurance quotes?

Full coverage auto insurance includes collision and comprehensive coverage, which offer more protection than a minimum liability policy.

Comprehensive and collision coverage pay for damage to your car. Full coverage typically also has higher liability limits than the minimums required by your state. This protects you if you cause an expensive accident.

Collision coverage pays for damage to your car after a crash with another vehicle or structure, regardless of whose fault it is.

- Hitting another car

- Crashing into a pole or fence

- Driving over a big pothole

Comprehensive coverage pays for damage to your car that's not strictly related to driving.

- Weather, including hail or storms

- Theft or vandalism

- Hitting animals like deer on the road

- Broken window or slashed tires

What else does a full coverage policy cover?

A full coverage policy also includes any other coverage your state requires. This could include uninsured motorist coverage or personal injury protection.

- Uninsured motorist coverage pays for your injuries and damage to your car if an uninsured driver hits you. Some states require this coverage.

- Underinsured motorist coverage pays for your expenses if you're hit by a driver who doesn't have enough car insurance to cover your costs.

- Personal injury protection (PIP) pays your medical bills if you’re injured in a crash, regardless of who caused it. PIP can also reimburse you for lost wages if you miss work while recovering. "No-fault" states may require PIP.

Is full coverage insurance worth it?

If your car is worth more than $5,000 or less than 8 years old, it's usually worth it to have full coverage.

It can help you avoid expensive repairs. Plus, you must have full coverage if you have a loan or lease.

Consider dropping your comprehensive and collision insurance when you can reasonably afford to replace your car. Your car insurance costs will drop. But you'll need to pay for a new car out of pocket if you cause an accident that totals your car.

Frequently asked questions

How much is full coverage insurance?

Full coverage car insurance costs $164 per month, on average. Some drivers can find cheaper rates from companies like State Farm, Erie or USAA.

Which company is the cheapest option for full coverage?

State Farm is the cheapest widely available option for full coverage auto insurance, at $124 per month. Drivers can also find cheap quotes from Erie and USAA.

What does full coverage car insurance cover?

Full coverage typically includes collision and comprehensive coverage. It usually has more liability coverage than your state's minimum requirements.

If your state requires uninsured and underinsured motorist coverage and personal injury protection, these coverages may be included in your full coverage policy. But the definition of full coverage varies by company.

Do I need full coverage on a financed car?

Yes, lenders require a full coverage policy with collision and comprehensive if you have a new car loan or lease. Once you pay off your loan, you're free to decide if you still need a full coverage policy.

Does full coverage car insurance replace your car?

Yes, a full coverage policy's collision coverage will pay for a new car or fix your vehicle if you cause an accident, minus your deductible. If another driver causes the accident, their liability coverage will pay to repair or replace your car.

Methodology

To find the best cheap full coverage insurance, ValuePenguin collected quotes from 50 states and the District of Columbia for the top insurance companies in each state. Rates are for a 30-year-old man who drives a 2015 Honda Civic EX. He has good credit and a clean driving record.

Full coverage limits are greater than any one state's minimum requirement and include uninsured and underinsured motorist bodily injury coverage. Comprehensive and collision insurance each had a $500 deductible.

- Bodily injury liability: $50,000 per person and $100,000 per accident

- Property damage liability: $25,000 per accident

- Uninsured and underinsured motorist bodily injury liability: $50,000 per person and $100,000 per accident

- Comprehensive and collision: $500 deductible

- Personal injury protection: Minimum, when required by state

The best car insurance companies for full coverage offered quotes in at least five states.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurance company filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.