What Are the Best Medicare Supplement Plans in Ohio?

Mutual of Omaha sells the best Medigap plans in Ohio, including the cheapest Plan G.

Compare Medicare Plans in Your Area

Aetna also has cheap rates, especially for Plan N. And Anthem is a good option if you want great customer service.

What's the best Medicare Supplement company in Ohio?

Mutual of Omaha has the best Medigap plans in Ohio.

The company's combination of low rates and high service ratings make it the best overall choice for Medigap plans in Ohio. Aetna is a good option for Plan N, which has good coverage and cheaper rates than Plan G. And Anthem Blue Cross Blue Shield has the bets customer service for Medicare Supplement plans in Ohio.

Top Medicare Supplement companies in Ohio

Company |

Customer satisfaction (out of 5.0)

| Plan G rate | ||

|---|---|---|---|---|

| Anthem Blue Cross Blue Shield | 5.0 | $141 | ||

| Mutual of Omaha | 4.5 | $121 | ||

| AARP/UnitedHealthcare | 4.0 | $127 | |

| Aetna | 3.0 | $132 | ||

| Medical Mutual of Ohio | 1.0 | $135 | ||

| Humana | 1.0 | $159 |

Compare Medicare Plans in Your Area

Plan G is the most popular Medicare Supplement plan in Ohio. About 45% of people in Ohio with Medigap plans have Plan G, likely because it has the best Medicare Supplement benefits if you became eligible for Medicare in 2020 or after.

Plan F is also popular, but you can only buy it if you were eligible for Medicare before 2020.

Best Medicare Supplement plans in Ohio: Mutual of Omaha

-

Editor rating

- *Plan G: $41

- Plan N: $87

- Plan A: $111

- Plan G: $121

- Plan F: $148

*High-deductible plan

Mutual of Omaha sells the best Medigap plans in Ohio.

The company has the cheapest Plan G in Ohio at $121 per month. Mutual of Omaha also has great customer service, getting 55% fewer complaints than an average company its size. That means most people are happy with the service they get from Mutual of Omaha.

Mutual of Omaha offers several extra benefits with its Medicare Supplement plans.

- Mutually Well: This program offers discounts on wellness services like massages and chiropractic visits. There's also an app that lets you create a personalized health plan, and you can buy an optional discounted fitness program membership.

- Amplifon Hearing Health Care: You can get reduced rates on hearing tests and discounts on hearing aids with this perk.

- EyeMed Vision Care: This lets you pay just $50 for an eye exam and gives you 40% off glasses frames (up to $140) at EyeMed-network offices.

Cheap rates for Plan N: Aetna

-

Editor rating

- *Plan G: $55

- Plan N: $87

- Plan A: $121

- Plan G: $132

- Plan B: $143

- Plan F: $165

*High-deductible plan

Aetna has some of the cheapest rates for Medigap Plan N in Ohio.

Plan N from Aetna costs $87 per month. That's $25 cheaper than the state average of $112 per month.

Plan N is a good idea if you're on a budget and want cheap rates but still need good coverage. Plan N has coverage that is almost as good as Plan G but at a lower monthly rate. But you'll have to pay a copay for doctor visits and emergency room trips if you have Plan N.

Aetna Medicare Supplement members might get a few extra perks. You can get more added benefits on Aetna Medicare Advantage plans. But Medicare Supplement plans still have better coverage than Medicare Advantage plans, even if a company doesn't have extra perks.

Best customer service: Anthem Blue Cross Blue Shield

-

Editor rating

- Plan N: $140

- Plan G: $141

- Plan A: $149

- Plan F: $196

Anthem has the best customer service for Ohio Medicare Supplement plans.

The company has very few complaints about its Medicare Supplement plans, which means most people are very happy with the service they get.

Choosing a company with good customer service can help you feel confident using your plan. Typically, companies with fewer complaints have a good claims process and are more helpful if you have questions.

Anthem's rates for Ohio Medigap plans tend to be expensive. But a plan from Anthem is still worth it if you want excellent service. And Plan G from Anthem is a bit cheaper than average, costing $141 per month. The average for Plan G in Ohio is $145 per month.

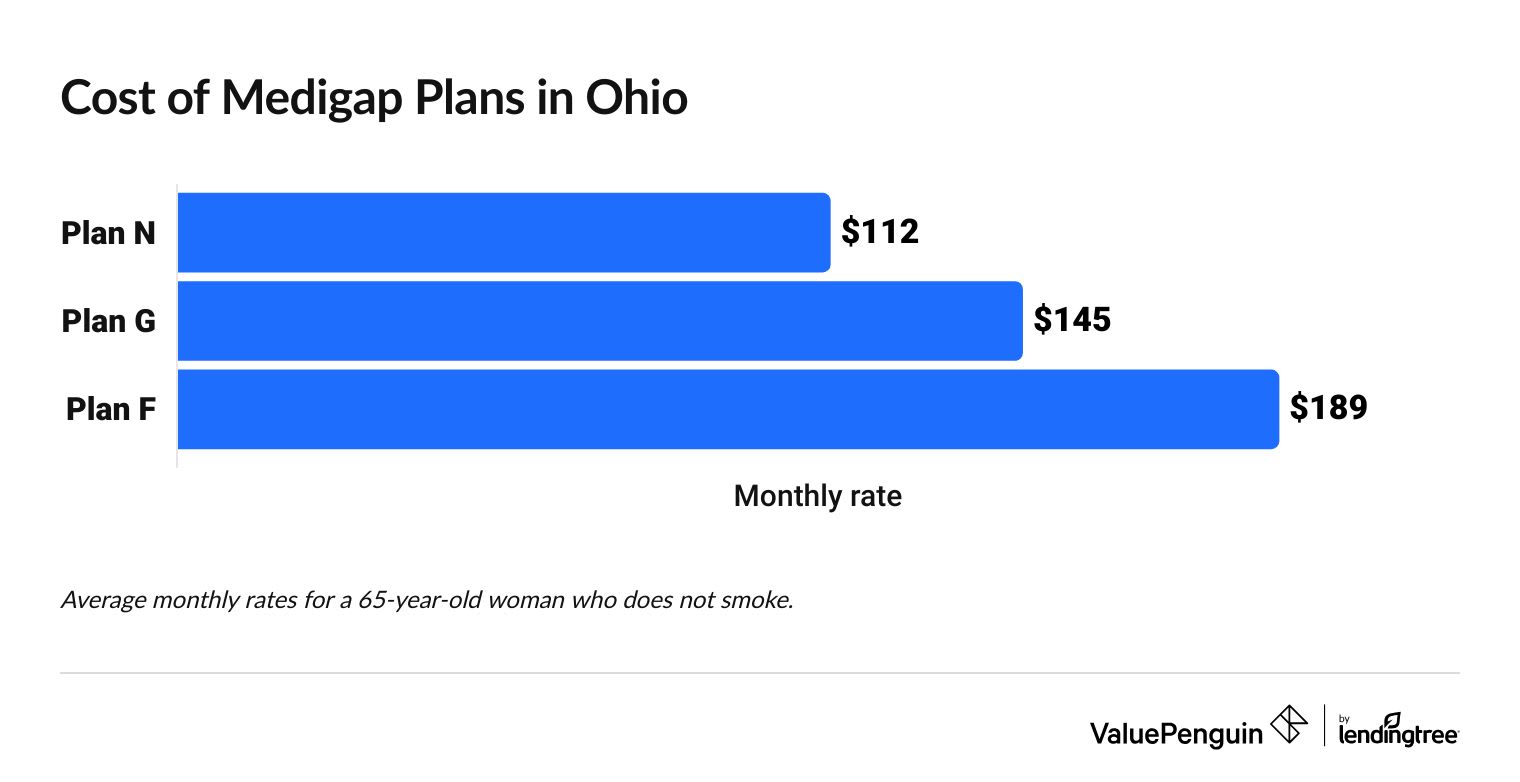

How much does a Medigap plan cost in Ohio?

Medicare Supplement plans in Ohio cost between $51 and $206 per month.

The amount you pay will depend on the plan you buy and the company you choose.

Compare Medicare Plans in Your Area

Plans G, F and N are the most popular in Ohio, making up 92% of all plans in the state. Plan C, the most expensive plan, makes up 4% of statewide plans. Despite being some of the cheapest options, Plans K and L are not popular, likely because they offer far less coverage than the other plans.

Ohio Medicare Supplement plan costs

Medigap plan | Monthly cost | Percentage of OH enrollment |

|---|---|---|

| G | $145 | 45% |

| F | $189 | 33% |

| N | $112 | 14% |

| C | $206 | 4% |

| D | $160 | 1% |

Ohio Medicare Supplement plans for people with disabilities

You might have trouble buying a Medigap plan in Ohio if you are under age 65.

Ohio doesn't require health insurance companies to offer Medicare Supplement plans to people who qualify for Medicare before they turn 65. This includes those who qualify for Medicare due to a disability, Lou Gehrig's disease (ALS) or kidney failure (end-stage renal disease or ESRD).

You might still be able to buy a policy, but your options are limited. You'll only be able to get a policy from health insurance companies that choose to offer plans to qualifying people under 65.

Frequently asked questions

What are the best Medicare Supplement plans in Ohio?

Medicare Supplement Plans F and G are the best Medigap plans in Ohio because of the amount of coverage they offer. As you're comparing Medigap plans, you should think about how much coverage you need and how much you can afford to pay each month.

How much do Ohio Medicare Supplement plans cost?

Medigap plans in Ohio cost between $51 and $206 per month. Plans with more coverage usually cost more. Medicare Supplement rates also change based on the company you choose. Your coverage will be the same, though, for any policy with the same plan letter, even if it's with a different company.

What company sells the cheapest Medicare Supplement plans in Ohio?

Aetna and Mutual of Omaha both sell cheap Medicare Supplement plans in Ohio. Plan G from Mutual of Omaha costs $121 per month, which is $24 cheaper than the state average. And both companies sell Plan N for an average of $87 per month, which is $25 cheaper than the state average.

Methodology and sources

Average Medicare Supplement rates for 2025 are based on actuarial data for private health insurance companies in Ohio. Rates are for a 65-year-old woman who doesn't smoke. These are the prices offered when enrollees first become eligible for a plan, with preferred rates and no medical underwriting. Only companies with a market share of 1.4% or above were analyzed.

The best plans are chosen based on a review of rates, customer satisfaction and financial strength ratings from AM Best. Plan popularity info comes from data compiled by America's Health Insurance Plans (AHIP).

Companies were assigned a customer satisfaction score based on average complaint data from the National Association of Insurance Commissioners (NAIC). The rankings are on a five-point scale, with higher scores meaning lower levels of complaints.

Satisfaction score | Customer complaints adjusted for company size |

|---|---|

| 5.0 (top rating) | Over 75% fewer complaints than typical |

| 4.5 | 50% to 75% fewer complaints than typical |

| 4.0 | 25% to 50% fewer complaints than typical |

| 3.5 | 0% to 25% fewer complaints than typical |

| 3.0 | An average rate of complaints |

| 2.5 | 0% to 50% more complaints than typical |

| 2.0 | 50% to 100% more complaints than typical |

| 1.5 | 100% to 250% more complaints than typical |

| 1.0 | Over 250% more complaints than typical |

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.