Blue Cross Blue Shield Health Insurance Review

Blue Cross Blue Shield (BCBS) is made up of independent health insurance companies that offer a range of health plans and operate separately in each state.

Find Cheap Health Insurance Quotes in Your Area

Blue Cross Blue Shield lets you choose from a large number of doctors, but it's often expensive.

Blue Cross Blue Shield (BCBS) makes it easy and convenient to find covered medical care. It's one of the biggest health insurance companies in the country.

Customer service ratings vary by region because BCBS is a group of independently operated regional companies.

Pros and cons

Pros

Accepted by more than 90% of doctors and hospitals

Affordable, high-quality plans

Available in every state

Comes with member perks, including discounts on health products

Cons

Higher rates than many competitors

Customer service ratings depend on where you live

Is Blue Cross Blue Shield good?

Yes, overall Blue Cross Blue Shield is a good insurance company. More than 90% of doctors and hospitals in the nation accept BCBS insurance. Its widespread availability makes it simple to get care.

Keep in mind that your specific network of doctors varies based on your plan. BCBS also offers some helpful member benefits, like a mobile app and a 24/7 nurse line, that can make navigating your health care benefits easier.

BCBS is one of the largest health insurance companies in the nation and offers individual and family policies, group health insurance, Medicare coverage, dental insurance and vision insurance.

Blue Cross Blue Shield Silver plan monthly cost

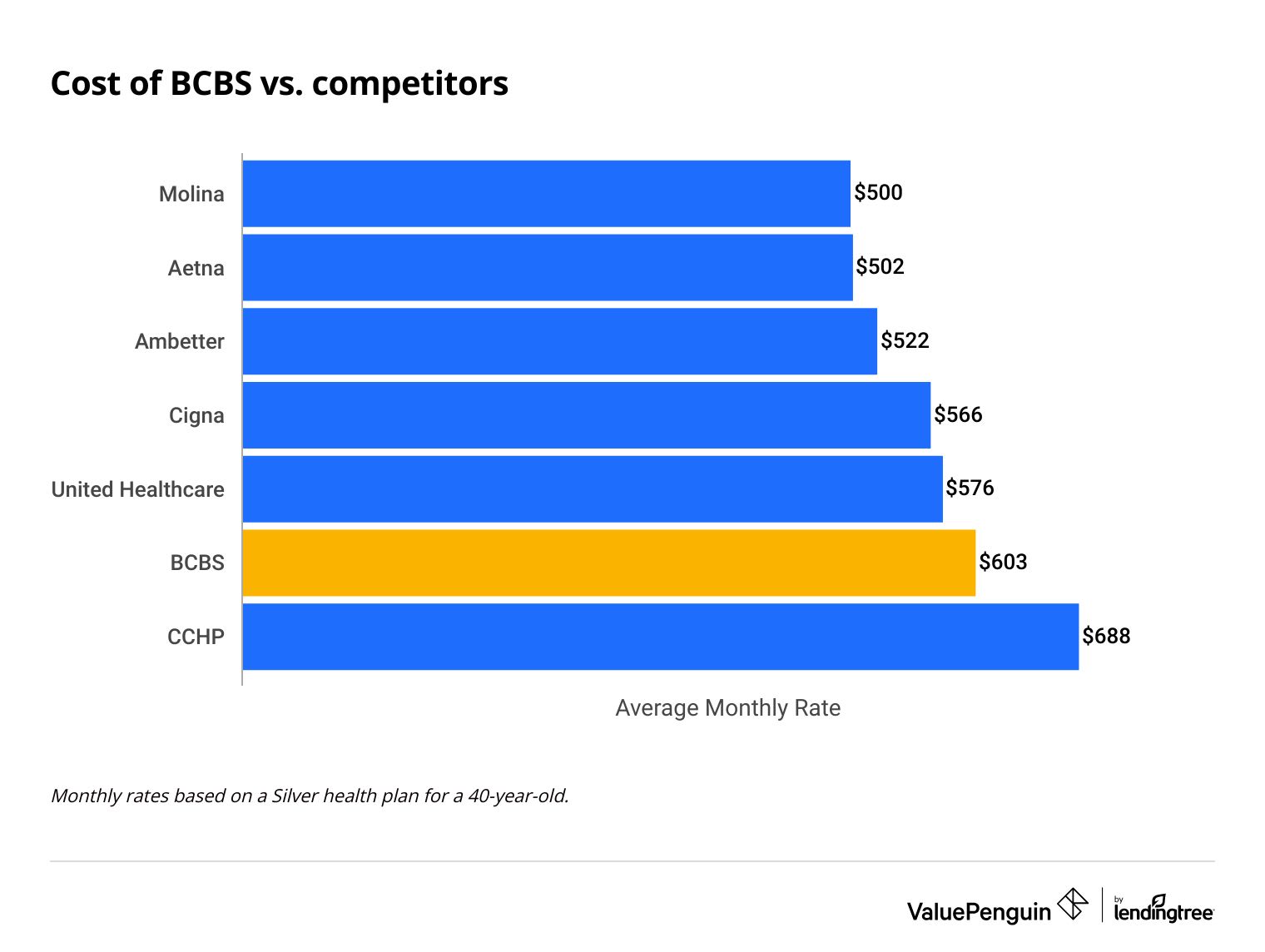

Overall, Blue Cross Blue Shield is more expensive for individual health insurance than its competitors. BCBS has an average monthly rate of $603 for a 40-year-old with a Silver plan. That makes BCBS one of the most expensive options among major health insurance companies.

Cost of BCBS vs. competitors

Company | Average cost |

|---|---|

| Molina | $500 |

| Aetna | $502 |

| Ambetter | $522 |

| Cigna | $566 |

| UnitedHealthcare | $576 |

| BCBS | $603 |

| CCHP | $688 |

Monthly rates are based on a 40-year-old with a Silver plan.

Blue Cross Blue Shield offers all five plan tiers, although specific plan availability depends on where you live. Plans with less coverage cost less but generally make you pay more when you get medical care.

Plan tier | Average monthly cost |

|---|---|

| Catastrophic | $369 |

| Bronze | $470 |

| Silver | $603 |

| Gold | $656 |

| Platinum | $1,099 |

BCBS's health insurance plans can be bought on the federal marketplace or a state marketplace as well as directly from the company. You can choose between Catastrophic, Bronze, Silver, Gold and Platinum plans, although some aren't available in some areas. If you buy coverage on a marketplace, you may be able to lower your rate with premium tax credits if you meet income requirements.

Where is Blue Cross available?

Blue Cross Blue Shield is in all 50 states and Washington, D.C.

The Blue Cross Blue Shield Association (BCBSA) is made up of 34 different companies. That means available plans, costs and customer service quality vary depending on where you live. The plans themselves range too, with different deductible, coinsurance and copay options depending on your regional subsidiary.

Customer service, plan quality and rates differ considerably between Blue Cross Blue Shield subsidiaries.

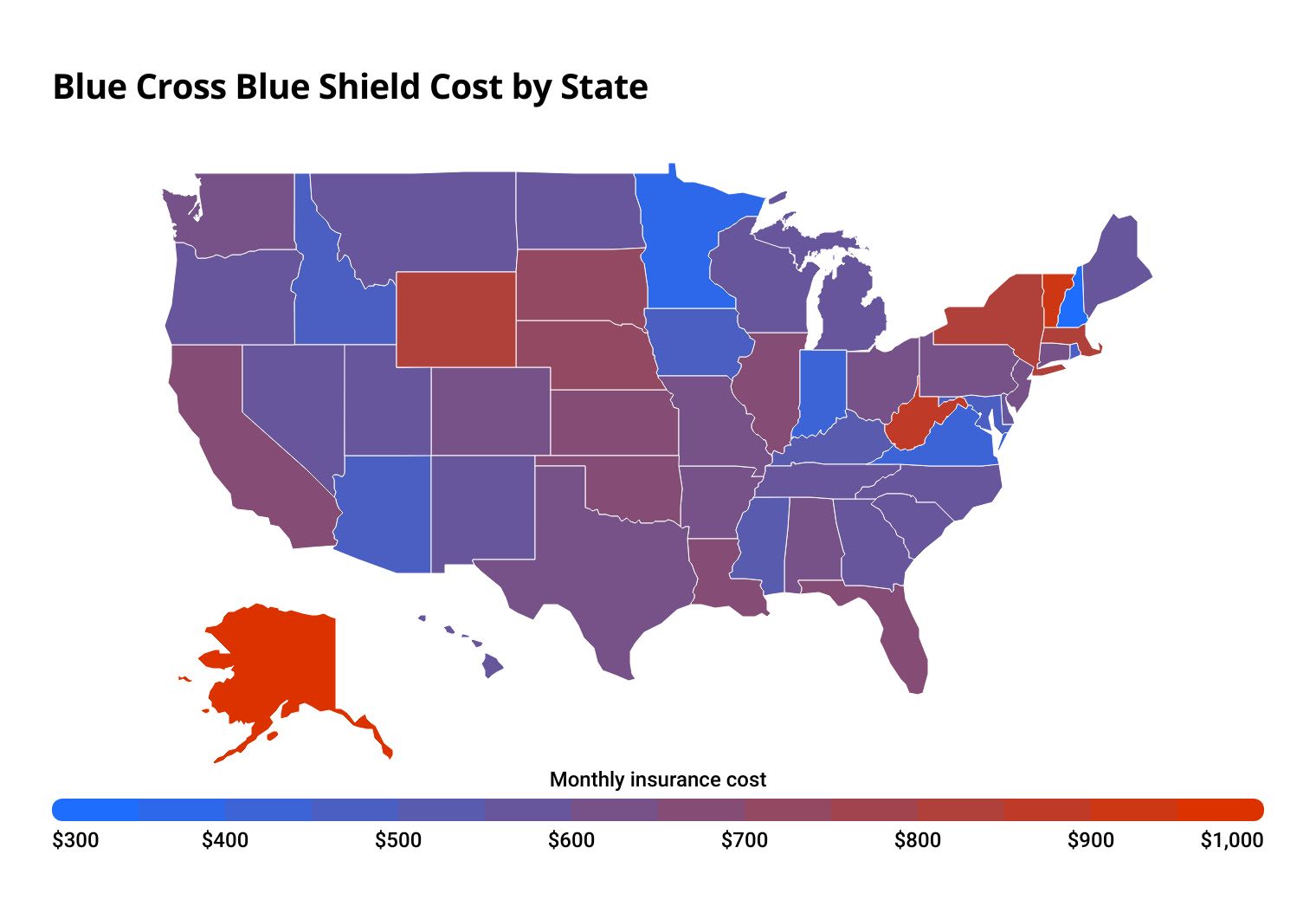

Blue Cross Blue Shield costs by state

State | Monthly rate |

|---|---|

| National average | $603 |

| Alabama | $600 |

| Alaska | $980 |

| Arizona | $487 |

| Arkansas | $610 |

Rates are based on a 40-year-old with a Silver plan.

Blue Cross Blue Shield subsidiaries typically operate in a specific region, which may cover one or more states. In some cases, multiple BCBS companies operate in a single state, and sometimes a single BCBS company offers coverage in several states. Coverage isn't always available statewide. Some BCBS entities may only offer policies in a few counties.

Largest BCBS subsidiary by state

State | BCBS company |

|---|---|

| Alabama | Blue Cross and Blue Shield of Alabama |

| Alaska | Premera Blue Cross and Blue Shield of Alaska |

| Arizona | Blue Cross Blue Shield of Arizona |

| Arkansas | Arkansas Blue Cross and Blue Shield |

| California | Blue Shield of California, Anthem Blue Cross |

Which Blue Cross Blue Shield plan is right for you?

Generally, Blue Cross Blue Shield offers private health insurance, group health insurance, vision and dental coverage, and Medicare options.

Each BCBS company controls its plan offerings, which means that options will differ by state and region. For example, Credence Blue Cross and Blue Shield, which is part of Blue Cross and Blue Shield of Alabama, may offer different plans than Blue Cross Blue Shield's Anthem subsidiary.

Blue Cross Blue Shield HMO and PPO plans

Blue Cross Blue Shield offers both HMO (health maintenance organization) and PPO (preferred provider organization) plans. Although the number and quality of BCBS HMO and PPO plans depends on where you live, you'll likely have access to at least one HMO and one PPO plan from Blue Cross Blue Shield.

-

HMO plans require that you choose a primary care doctor. You must get a referral from this doctor before you see a specialist. You're also restricted to a network of doctors. You can only go outside this network if you have an emergency. HMOs are typically cheaper than PPOs.

- PPO plans don't require you to have a primary care doctor. You can also see a doctor who isn't in your network, although you'll have to pay more for out-of-network medical care. PPOs tend to be more expensive than HMOs.

Similar to most health insurance companies, BCBS charges more for PPO plans compared to HMO plans. A typical HMO plan from BCBS will cost $539 per month on average for a 40-year-old with a Silver health plan. By contrast, a BCBS PPO plan costs $685 per month on average.

That comes out to a $1,752 per year difference. It may be worth paying the higher cost if you highly value seeing specialists without a referral or if you strongly prefer having more flexibility when it comes to choosing your doctor. However, budget-conscious consumers will usually be better served by an HMO plan.

Medicare

BCBS offers Medicare Advantage plans, which cost an average of $38 per month when drug coverage is included. Its plans are rated about average by the Centers for Medicare & Medicaid Services (CMS). However, individual plan ratings range widely.

Blue Cross Blue Shield also sells Medicare Supplement plans and separate Part D (drug coverage) plans. If you are eligible for both Medicare and Medicaid, BCBS has a plan that can get you the most value from both.

Highlights of these plans include large networks of doctors, gym and wellness benefits, coverage for hearing aids, and dental and vision benefits, depending on the plan you choose.

Member resources and unique benefits

Most Blue Cross Blue Shield companies offer a variety of member benefits, but those will change with the BCBS affiliate in your area. Some of the more common member benefits are:

- A 24/7 nurse line

- Blue365 for discounts on health and fitness clubs, weight loss programs and other health-related products

- Telemedicine

- A mobile app and a separate member website

- International coverage for those who work, travel or live abroad

Blue Cross Blue Shield reviews and customer complaints

Blue Cross plan quality and customer service vary widely depending on where you live because Blue Cross Blue Shield operates as a collection of semi-independent organizations. In some areas, BCBS has very high ratings and low customer complaint levels, while in other places it has below-average ratings.

For example, BCBS of Georgia gets 42% more complaints compared to an average health insurance company its size according to the National Association of Insurance Commissioners (NAIC). However, BCBS of Illinois is part of Health Care Service Corp., which gets 57% fewer complaints than average according to the NAIC.

J.D. Power's 2023 health plan member satisfaction study also shows large differences between BCBS subsidiaries. Blue Cross Blue Shield scored last in California and well below average in Colorado. In contrast, BCBS subsidiaries took first place in Florida and the Delaware-West Virginia-Washington, D.C., region.

This wide range in customer satisfaction means that it's crucial to research the performance of your local subsidiary before you buy a plan.

Frequently asked questions

Is Blue Cross Blue Shield good insurance?

Blue Cross Blue Shield is a good choice for many people. The company has a large network of doctors and offers member benefits, including a nurse line and telemedicine options, all of which can make finding a doctor easier. Because the company is split into independent regional subsidiaries, customer service and quality ratings vary, so you may want to research the BCBS company in your area.

Is Anthem the same as BCBS?

Anthem (renamed to Elevance in 2022) is part of the BCBS family of companies. Anthem Blue Cross Blue Shield is the BCBS company in several states, although it isn't available everywhere.

Is Blue Cross Blue Shield expensive?

Compared to other major health insurance companies, Blue Cross Blue Shield is relatively expensive. The average monthly cost of a Silver plan from Blue Cross Blue Shield is $603 per month, based on a 40-year-old individual. For comparison, Aetna's average monthly rate is $502 and Cigna's is $566 for the same level plan.

Methodology

Company- and plan-level health insurance rates are based on aggregated private health insurance data from the Centers for Medicare & Medicaid Services (CMS) for plans sold on HealthCare.gov. States that use their own health insurance marketplace rather than HeathCare.gov are not included in average rates. All rates are averages for a 40-year-old who doesn't smoke.

The average cost of a Blue Cross Blue Shield Medicare Advantage plan is based on data from Medicare.gov and the Centers for Medicare & Medicaid Services (CMS) and includes drug coverage. Employer-sponsored plans, Medicare savings account (MSA) plans, Medicare-Medicaid plans, PACE plans, Part-B-only plans, prepayment plans (HCPPs), sanctioned plans and special needs plans are not included in average rates.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.