Harvard Pilgrim Health Care Review

Harvard Pilgrim Health Care has good benefits and customer satisfaction, but it's usually more expensive than other insurance companies.

Find Cheap Health Insurance Quotes in Your Area

Harvard Pilgrim is a good choice for reproductive health care coverage. Some of its plans cover in vitro fertilization, which isn't covered by many insurance companies. But Harvard Pilgrim is only available in Maine, Massachusetts and New Hampshire. And the company had a data breach in 2023, leading to identity fraud concerns.

Pros and cons

Pros

High customer satisfaction

Several marketplace plan options

Good reproductive health coverage

Cons

Plans are expensive

Cybersecurity concerns

Only available in New England

How much does Harvard Pilgrim cost?

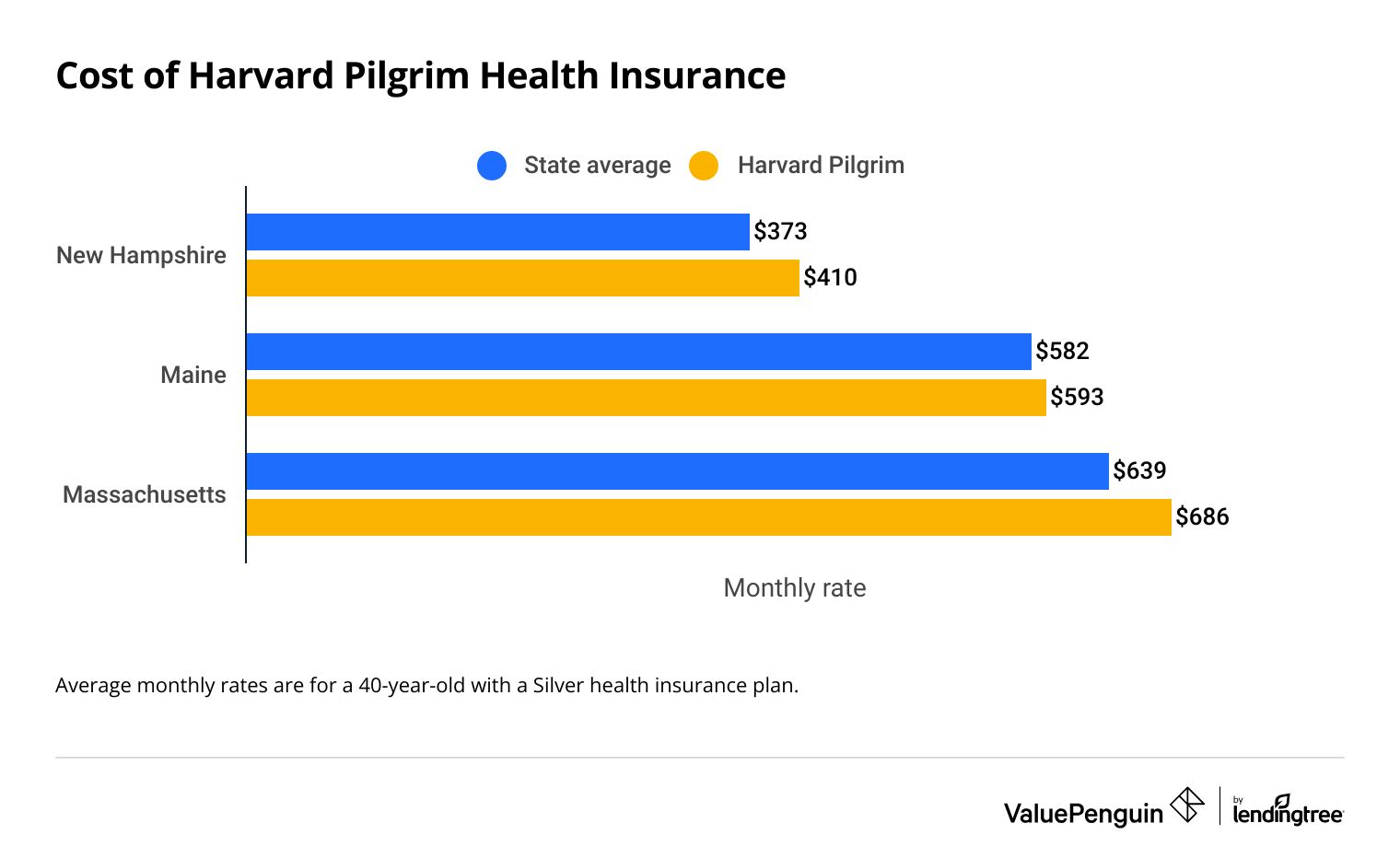

A Silver health insurance plan from Harvard Pilgrim costs an average of $563 per month.

Health insurance plans from Harvard Pilgrim Health Care are only available in three states: Maine, Massachusetts and New Hampshire. No matter what state you live in, you can probably get a cheaper plan with another health insurance company.

Find Cheap Health Insurance in Your Area

If you live in Maine, you might want to consider Harvard Pilgrim even if you're looking for cheap health insurance. The company's rates are closer to average in the Pine Tree State. Because rates vary based on your personal situation, Harvard Pilgrim could still be a good option.

Harvard Pilgrim health insurance rates

Maine

Massachusetts

New Hampshire

Plan tier | Harvard Pilgrim rate | State average |

|---|---|---|

| Bronze | $500 | $485 |

| Silver | $593 | $582 |

| Gold | $680 | $666 |

Average monthly rates for a 40-year-old.

Maine

Plan tier | Harvard Pilgrim rate | State average |

|---|---|---|

| Bronze | $500 | $485 |

| Silver | $593 | $582 |

| Gold | $680 | $666 |

Average monthly rates for a 40-year-old.

Massachusetts

Plan tier | Harvard Pilgrim rate | State average |

|---|---|---|

| Bronze | $491 | $476 |

| Silver | $686 | $639 |

| Gold | $784 | $706 |

Average monthly rates for a 40-year-old.

New Hampshire

Plan tier | Harvard Pilgrim rate | State average |

|---|---|---|

| Bronze | $328 | $307 |

| Silver | $410 | $373 |

| Gold | $463 | $398 |

Average monthly rates for a 40-year-old.

How much is a Harvard Pilgrim Medicare Advantage plan?

A Medicare Advantage plan from Harvard Pilgrim costs an average of $63 per month. Plans are only available in New Hampshire, where the state average cost for Medicare Advantage is $26 per month. Like its health insurance plans, Harvard Pilgrim's Medicare Advantage plans aren't usually the most affordable option.

What do Harvard Pilgrim Medigap plans cost?

Harvard Pilgrim also tends to be an expensive option for Medicare Supplement plans, but it could be a cheap option for the most popular plans depending on your state. If you are eligible for a Plan F and you live in Maine, or if you want a Plan G and live in New Hampshire, Harvard Pilgrim could be a good option because it has cheap rates.

And if you live in Massachusetts, Harvard Pilgrim could also be a good option because its rates are close to the state average.

Maine

Massachusetts

Plan | Harvard Pilgrim rate | State average |

|---|---|---|

| Core | $139 | $138 |

| Supplement | $246 | $245 |

| Supplement 1A | $199 | $198 |

Average monthly rates for a 65-year-old woman who does not smoke. Massachusetts structures its Medigap plans differently than other states.

Find Cheap Health Insurance in Your Area

Harvard Pilgrim Health Care plans

Harvard Pilgrim is a smaller company, but it still sells several types of health insurance. You can buy individual and family health insurance, Medicare Advantage and Medicare Supplement plans, depending on where you live.

Harvard Pilgrim is part of an organization called Point32Health, which also includes CarePartners of Connecticut and Tufts Health Plan. Point32Health is a not-for-profit, and health insurance plans are still sold under the "Harvard Pilgrim" name.

Individual and family plans

Harvard Pilgrim sells individual and family health insurance plans in Maine, Massachusetts and New Hampshire. You can buy a plan between Nov. 1 and Jan. 15 each year, which is called open enrollment. You might be able to buy a plan outside these dates if you have recently moved, gotten married, had a baby or lost your job.

To buy a plan in New Hampshire, go to HealthCare.gov. Both Maine and Massachusetts use their own state-run marketplaces. Maine's is called CoverME and Massachusetts' is called Massachusetts Health Connector.

Medicare Advantage plans

Harvard Pilgrim only sells Medicare Advantage plans in New Hampshire. You can choose from four plans, which range from $0 to $132 per month. All plans cover a higher amount for your prescription medications, called "enhanced drug coverage."

All Harvard Pilgrim Medicare Advantage plans cover acupuncture, chiropractic care, hearing aids, dental and vision care, virtual doctor appointments and massage therapy. You can also get reimbursed for your gym membership or fitness classes.

Medicare Supplement plans

Harvard Pilgrim sells Medicare Supplement plans, also called Medigap plans, in Maine, Massachusetts and New Hampshire. In ME and NH, you can choose between Plans A, F, G, M and N.

Massachusetts organizes its Medigap plans differently than other states. In Massachusetts, you can buy a Core Plan, a Supplement 1 Plan or a Supplement 1A Plan through Harvard Pilgrim.

Because all Medicare Supplement plans are required by law to include the same key benefits, cost is the main factor to consider when shopping around. In Maine, Harvard Pilgrim might be a good choice for Plan F, which you can only buy if you were eligible for Medicare before 2020. In New Hampshire, it could be a good choice for Plan G. And in Massachusetts, all of Harvard Pilgrim's plans have average rates. Otherwise, you can likely find a cheaper plan with another company.

Harvard Pilgrim benefits and perks

Harvard Pilgrim offers several extra perks and member benefits on its plans. These range from telehealth to coverage for in vitro fertilization (IVF) therapy and mental health counseling.

- Doctor On Demand: This service lets you speak to a licensed medical professional through a smartphone app or web portal at any time. Doctor On Demand is geared toward less serious illnesses and injuries, such as colds, allergies and migraines. You can also use Doctor On Demand for mental health support. You shouldn't use it for serious issues, like broken bones or chest pain.

- Mental health counseling: Many Harvard Pilgrim plans help pay for therapy. Coverage varies, so check your plan's details or talk with a company representative to see if mental health coverage is included for you.

In vitro fertilization (IVF) coverage

Harvard Pilgrim covers in vitro fertilization (IVF), one of the most common fertility treatments for those with issues getting pregnant, on some of its plans. According to the American Society for Reproductive Medicine, an IVF treatment costs $12,400 on average. Because of the high cost, insurance coverage can be a deciding factor if you're considering IVF.

Customer reviews and complaints

Harvard Pilgrim has built a strong reputation for customer service and satisfaction.

However, a data breach in 2023 put millions of Harvard Pilgrim plan holders at risk for identity fraud.

Harvard Pilgrim data breach

In March 2023, Harvard Pilgrim experienced a ransomware cybersecurity attack that put upward of 2.5 million user profiles at risk. Victims of the data breach have organized a class action lawsuit against the company.

Overall, Harvard Pilgrim has 60% fewer complaints about its health insurance plans than expected for a company its size, according to the National Association of Insurance Commissioners (NAIC).

Harvard Pilgrim Health Care ranked second in J.D. Power's 2022 Massachusetts customer satisfaction survey for group plan health insurance.

However, in the 2023 version of the study, Point32Health was ranked in last place in Massachusetts. Remember that Point32Health includes other companies, not just Harvard Pilgrim.

The insurer has a 4.5/5 star rating from the National Committee for Quality Assurance (NCQA). This reflects an overall high level of care and service. NCQA singled out Harvard Pilgrim for its prevention services. The patient experience and treatment categories earned 3.5/5 stars, signaling slightly above-average quality levels.

Frequently asked questions

What is Harvard Pilgrim Health Care?

Harvard Pilgrim Health Care (HPHC) is a regional health insurance company that sells plans in Maine, Massachusetts and New Hampshire. It's part of a larger company called Point32Health, which also includes Tufts Health Plan and CarePartners of Connecticut.

Is Harvard Pilgrim good insurance?

Yes, Harvard Pilgrim has consistently earned high ratings from customer surveys and from third-party organizations like the National Committee for Quality Assurance (NCQA). The company sells several kinds of health insurance with good coverage and perks. However, Harvard Pilgrim is usually more expensive than other health insurance companies.

What happened to Harvard Pilgrim Health Care?

Between March and April 2023, Harvard Pilgrim's sensitive data files were exposed in a cyberattack. Harvard Pilgrim has taken steps to combat problems stemming from the data breach, but identity theft is still an ongoing concern for victims of the attack.

Methodology

For health insurance rates, ValuePenguin used publicly available data from the Centers for Medicare & Medicaid Services (CMS) to create average 2024 monthly rates for Harvard Pilgrim Health Care and state averages. Rates are for a 40-year-old with a Silver plan, unless otherwise noted. The national average cost for a Harvard Pilgrim health plan was calculated by averaging the average rates for a Silver plan in the three states where plans are sold. Plans and providers for which county-level data was included in the CMS Crosswalk file were used in our analysis; those excluded from this data set may not appear.

Medicare Advantage rates are from CMS. Rates are for 2024 Medicare Advantage plans that include prescription drug coverage. This analysis excludes employer-sponsored plans, Medicare-Medicaid plans, Medicare savings account (MSA) plans, sanctioned plans, Special Needs Plans (SNPs), Program of All-Inclusive Care for the Elderly (PACE) plans and prepayment plans (HCPPs).

Medigap rates are based on actuarial data from private health insurance companies. Medicare Supplement prices are preferred rates for a 65-year-old woman who doesn't smoke. The rates represent the cost at initial enrollment, when someone first becomes eligible and health issues are not factored into the price.

Rankings and survey data are from NCQA and the National Association of Insurance Commissioners (NAIC). Average complaint rates from the NAIC were sourced by averaging overall complaint indexes for Harvard Pilgrim Health Care of New England (NAIC # 96717) and Harvard Pilgrim Health Care Incorporated (NAIC # 96911). Ratings are from the 2022 and 2023 J.D. Power US Commercial Member Health Plan Study.

Other sources include Point32Health and a study on in vitro fertilization and insurance coverage.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.