QA TEST Page - Car Insurance Calculator: Estimate your Car Insurance Cost

Car insurance cost calculator

Use our car insurance calculator to estimate the cost of your personalized insurance policy.

Car Insurance Coverage Calculator

Our tool calculates your customized insurance rates.

We'll show you the average cost of our recommendation, or the cost of a policy you customize yourself.

First, let’s see what the minimum coverage requirements are in your state.

Car insurance estimates by company

State Farm and Geico are the cheapest national car insurance companies.

Erie, Auto-Owners and Mercury have the cheapest car insurance overall. But they're only available in some states.

Average car insurance rates for minimum coverage

Car insurance estimates are a good starting point. But your rates will vary because quotes are based on factors like your age, your driving record, where you live and the coverage you choose. And each company has its own way of calculating your rate.

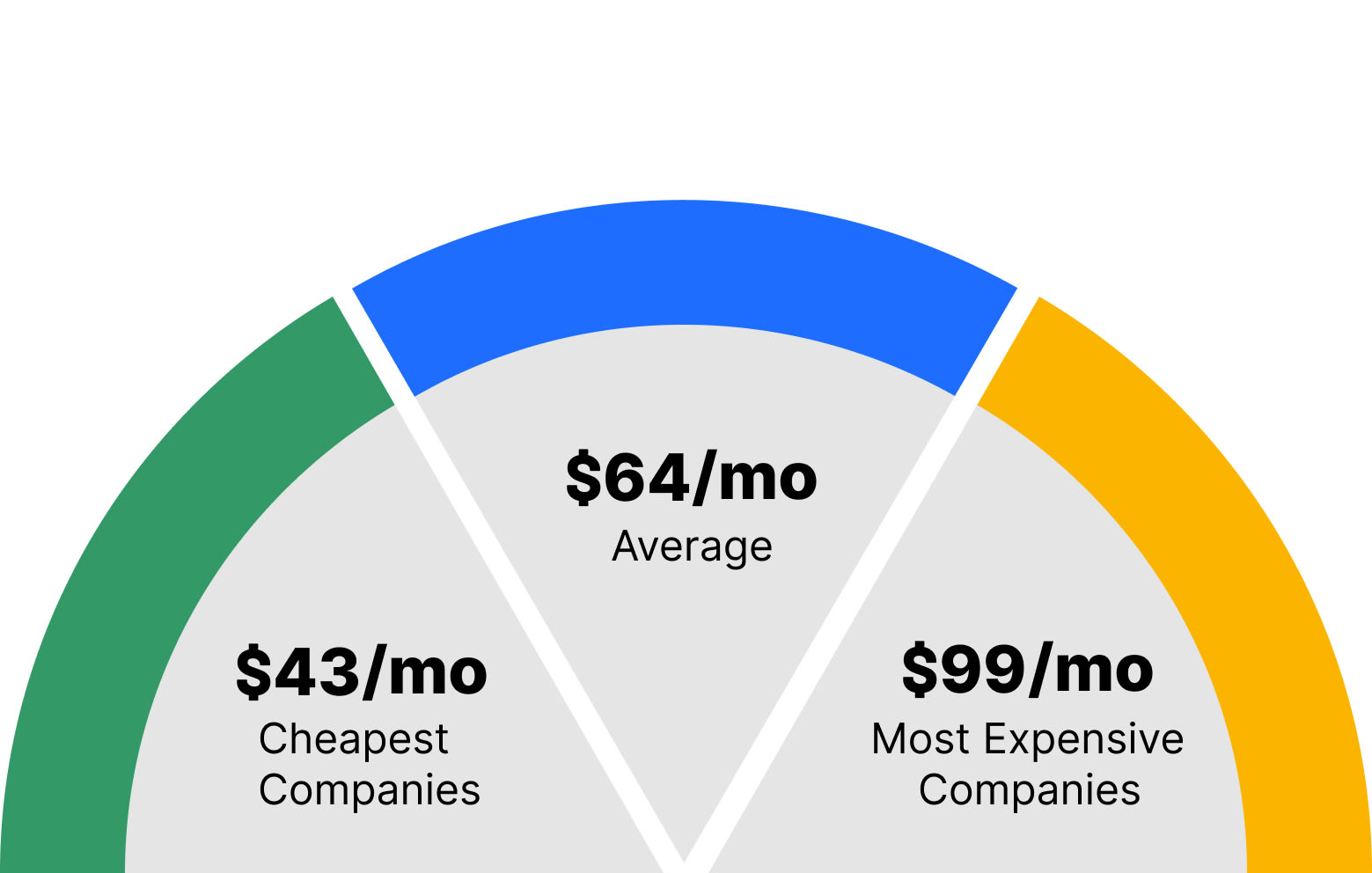

Cheapest

Average

Most expensive

Companies | Monthly rate | ||

|---|---|---|---|

| Erie | $41 | ||

| Auto-Owners | $43 | ||

| Mercury | $43 | ||

| Farm Bureau | $46 | ||

| State Farm | $50 | ||

| USAA* | $34 | ||

*USAA car insurance is only available to members of the military, veterans and their families.

Cheapest

Companies | Monthly rate | ||

|---|---|---|---|

| Erie | $41 | ||

| Auto-Owners | $43 | ||

| Mercury | $43 | ||

| Farm Bureau | $46 | ||

| State Farm | $50 | ||

| USAA* | $34 | ||

*USAA car insurance is only available to members of the military, veterans and their families.

Average

Companies | Monthly rate | ||

|---|---|---|---|

| American Family | $61 | ||

| Geico | $61 | ||

| Shelter | $64 | ||

| Progressive | $66 | ||

| Travelers | $70 | ||

Most expensive

Companies | Monthly rate | ||

|---|---|---|---|

| Nationwide | $80 | ||

| Amica | $91 | ||

| Allstate | $96 | ||

| Farmers | $99 | ||

| AAA | $127 | ||

Find Cheap Auto Insurance Quotes Near You

Estimates for car insurance by state

Where you live greatly impacts how much you pay for car insurance. For example, in Michigan, the most expensive state, full coverage car insurance costs $509 more per month than in the cheapest state, Maine.

Insert filter table

How to calculate your car insurance costs

How to estimate car insurance costs

To estimate the cost of car insurance, you must decide what kinds of coverage you need.

The best car insurance coverage for you depends on your budget, your car's value and your state's requirements.

The most basic car insurance coverages are bodily injury liability, property damage liability, collision coverage and comprehensive coverage.

Before deciding which insurance coverages to add, compare cost estimates for each coverage type. Then, review your auto insurance estimates yearly to find the cheapest rates and decide if you need different coverage.

Bodily injury liability

Bodily injury liability coverage pays for other drivers' medical costs and lost wages if you cause an accident.

Most states require bodily injury liability coverage.

Limit per person | Limit per accident | Monthly cost |

|---|---|---|

| $25,000 | $50,000 | $52 |

| $50,000 | $100,000 | $63 |

| $100,000 | $300,000 | $74 |

| $250,000 | $500,000 | $89 |

Property damage liability

Property damage liability pays for damage to other people's property if you cause an accident. This includes crashing into another car or object.

Each state has its own requirement for property damage liability. The requirement typically ranges from $5,000 to $25,000.

Limit per accident | Monthly cost |

|---|---|

| $25,000 | $27 |

| $50,000 | $28 |

| $100,000 | $29 |

Uninsured and underinsured motorist bodily injury coverage

Uninsured and underinsured motorist bodily injury coverage pays your medical bills if you're in an accident caused by an uninsured or underinsured driver.

It can also cover lost wages and pay for someone to do household tasks you can no longer perform yourself. This can include cleaning your house or babysitting.

Twenty states require uninsured and underinsured motorist coverage.

Limit per person | Limit per accident | Monthly cost |

|---|---|---|

| $25,000 | $50,000 | $8 |

| $50,000 | $100,000 | $11 |

| $100,000 | $300,000 | $16 |

| $250,000 | $500,000 | $16 |

Comprehensive and collision

Full coverage insurance includes comprehensive and collision coverage. These coverages pay for repairs to your car after an accident on or off the road, no matter who's at fault. Comprehensive and collision coverage have no limit, other than the value of your car.

You'll need this coverage if you have a loan or lease. But it's expensive, often doubling the cost of insurance.

Coverage type | Deductible | Monthly rate |

|---|---|---|

| Collision | $500 | $56 |

| Collision | $1,000 | $46 |

| Comprehensive | $500 | $19 |

| Comprehensive | $1,000 | $14 |

What factors do insurance companies use to calculate your car insurance cost?

Insurance companies calculate your car insurance rate based on several factors. For instance, companies use your age and accident history to determine your "riskiness" as a driver. Young drivers and people with a ticket or accident typically pay more for insurance than someone older or with a clean driving record.

Factors that affect car insurance estimates

Younger drivers tend to pay more for car insurance, especially teens. This is because young drivers have less experience behind the wheel and are more likely to cause a crash.

Your rates will go down as you get older. But young drivers can save money by signing up for usage-based driving programs and practicing safe habits.

You'll usually pay more for insurance after a ticket, DUI or accident.

The best way to find cheap rates after a ticket or accident is to compare quotes from multiple companies. Every company calculates rates differently, and some may raise your rates less after a ticket or accident.

It's cheaper to insure cars that are older, slower or safer.

If your car insurance rates are unaffordable, consider trading your car in for a vehicle that's cheaper to cover.

People who drive less tend to pay lower rates. If you drive fewer than 12,000 miles per year, you may be able to save money with pay-per-mile car insurance.

Married people often pay slightly less for car insurance than unmarried drivers.

In addition, you'll pay much more if you have a teenager on your policy. You can find the cheapest family car insurance policy by shopping around for quotes from multiple companies.

Higher coverage limits and extra add-ons will raise your car insurance rates. To lower your rates, eliminate coverage you don't need.

For example, comprehensive and collision insurance can be costly. If you don't have a car loan or lease, consider removing these coverages if your car is over 8 years old or worth less than $5,000.

Raising your deductible can save you money. But make sure to choose a deductible you can easily afford to pay after an emergency.

The best companies nationally may not have the cheapest car insurance near you. You should compare quotes from small and midsize companies in your area along with major car insurance companies to find the best rates.

The best way to get cheaper rates is to improve your credit score. But that can take some time.

In the short term, try to find a company that offers lots of discounts you can easily qualify for. You can also consider a usage-based car insurance program if you're able to practice safe driving habits.

How can you get cheaper auto insurance estimates?

To find the most affordable insurance, get quotes from several companies. Also, look for discounts for bundling or automatic payments.

Compare quotes from multiple companies. Car insurance rates can differ by an average of $245 per month for full coverage from one company to the next. Get quote estimates from large insurance companies like State Farm and Geico and smaller ones like Erie and Farm Bureau.

Look for discounts. Most companies, especially large ones like Geico or State Farm, have a lot of discounts available. These discounts can add up to savings of 40% or more. And you may already qualify for many of them.

If you live with other drivers, consider a multicar policy. Adding another person to your insurance plan is cheaper than having two separate policies. You can share a multicar policy with anyone you live with.

Bundle with other insurance. Most major insurance companies offer the option to bundle your home or renters insurance with your auto insurance. Choosing a bundle deal can get you a discount on your total insurance cost for both policies.

Shop around every year. If your life situation or driving record has changed since you bought your policy, you may be able to get a cheaper rate. Improving your credit score, getting married or staying accident-free might help you save.

Calculate how much auto insurance you need

How much car insurance you need depends first on your state's minimum required coverage and how much protection you want.

Most states require:

- $20,000-$25,000 of bodily injury liability insurance per person

- $40,000-$50,000 of bodily injury liability insurance per accident

- $10,000-$25,000 of property damage liability insurance

Some states also require uninsured motorist coverage or personal injury protection (PIP).

Start with your state's minimum required insurance, then add higher coverage amounts and extra coverage options based on what you can afford. It doesn't cost much to add more liability coverage to your policy. It can also help you avoid a big bill if you cause a major crash.

How much insurance should you get?

The right amount of auto insurance coverage depends on your budget and driving background.

For example, you can typically double your liability coverage limits for $10 to $15 per month. This can help you avoid expensive bills after a crash, like if you hit an electric vehicle.

On the other hand, if you drive an older car that's not worth much, you won't need collision and comprehensive coverage.

Liability insurance

- What is it? Liability insurance pays for damage and injuries to other drivers after you cause an accident.

- Do you need it? Every state except New Hampshire requires liability insurance.

- How much should you have? State minimums usually aren't high enough to pay for the average accident. However, more coverage will raise your rates. You should get as much liability insurance as you can afford.

Comprehensive and collision

- What is it? Collision coverage pays to fix your car after an accident with another vehicle or object, regardless of who's responsible. Comprehensive coverage pays to repair your car from a cause besides a crash, like hail.

- Do you need it? Yes, if you have a loan or lease. Also, consider this coverage if your car is worth more than $5,000 or you couldn't afford to replace it after a major crash.

- Which deductible should you choose? Pick a deductible based on the amount you could easily pay in an emergency.

Personal injury protection

- What is it? Personal injury protection (PIP) covers drivers' and passengers' medical costs and lost wages after an accident, regardless of who's at fault.

- Do you need it? There are 12 states that require PIP. PIP is a good idea if your health insurance has high copays or deductibles. It's also smart to have PIP if you don't have an emergency fund to cover lost wages.

- How much should you have? Your state may require a minimum amount of PIP. Choose an amount you think would cover your out-of-pocket costs for medical care after a major accident.

Uninsured or underinsured motorist

- What is it? Uninsured or underinsured motorist coverage pays for your injuries or repairs after an accident with a driver who doesn't have insurance or doesn't have limits high enough to pay your bills.

- Do you need it? In 20 states and Washington, D.C., drivers must have uninsured or underinsured motorist coverage. Even if your state doesn't require it, you should still consider getting it. It's affordable, and 1 in 8 drivers do not have car insurance.

- How much coverage should you have? The same limits as your liability coverage for bodily injury and property damage.

The minimum liability requirement may be enough to cover the costs of a minor accident. However, it won't be enough for repairs after a major accident. Consider getting more coverage if you can afford it.

Average claim amounts

Claim type | Average claim amount |

|---|---|

| Bodily injury liability | $20,235 |

| Property damage liability | $4,711 |

| Collision | $3,588 |

| Comprehensive | $1,995 |

Frequently asked questions

How much should I be paying for car insurance?

The average cost of minimum coverage car insurance in the United States is $64 per month. Full coverage typically costs around $164 per month. However, your rates will vary based on where you live, your insurance company, what kind of car you have and your driving history.

How do I estimate car insurance costs?

The best way to estimate the cost of auto insurance is to use our online car insurance calculator. By answering three easy questions, you can estimate your car insurance rates based on your location, your car and how much coverage you need.

How much car insurance do I need?

At the very least, you need enough car insurance to meet the minimum legal requirements in your state. However, you should buy more coverage if you drive a lot, have a newer car or are paying off a car loan or lease.

What kind of car insurance should I get?

Nearly every state requires you to have liability insurance, which pays for injuries to other people and property damage. But it's worth it to pay more for full coverage if your car is worth over $5,000 or less than 8 years old. Higher limits and extra coverage can also help you avoid unexpected bills after a crash.

Methodology

Our car insurance calculator is based on millions of car insurance quotes from every ZIP code in the U.S., using multiple coverage limits. Rates are for a 30-year-old man with good credit and a good driving history who drives a 2015 Honda Civic EX.

Insurance analysts and agents recommended matching a driver's net worth to their coverage. Estimates from our calculator default to higher coverage limits for higher-net-worth drivers.

We gathered quotes from ZIP codes across Georgia using the same driver profile above to calculate costs for each coverage type. Claim payouts are based on a 2020 study from the Insurance Services Office.

Rate data was compiled using Quadrant Information Services. Your quotes may differ, as these rates are averages and are best used only for comparative purposes.

Car insurance estimates by company

Auto-Owners and Erie have the cheapest car insurance, but they're not available in every state. State Farm and Geico are the cheapest companies that sell policies in all states.

Car insurance estimates are a good starting point, but your actual insurance rates will vary based on factors like your age, your driving record, where you live and the amount of coverage you choose.

Average car insurance rates for minimum coverage

Cheapest

Average

Most expensive

Company | Cost per month | |

|---|---|---|

| Auto-Owners | $36 | |

| Erie | $39 | |

| Farm Bureau | $43 | |

| State Farm | $41 | |

| USAA* | $31 |

*USAA car insurance is only available to members of the military, veterans and their families.

Cheapest

Company | Cost per month | |

|---|---|---|

| Auto-Owners | $36 | |

| Erie | $39 | |

| Farm Bureau | $43 | |

| State Farm | $41 | |

| USAA* | $31 |

*USAA car insurance is only available to members of the military, veterans and their families.

Average

Company | Cost per month | |

|---|---|---|

| Geico | $52 | |

| American Family | $53 | |

| Progressive | $63 | |

| Travelers | $63 |

Most expensive

Company | Cost per month | |

|---|---|---|

| Nationwide | $69 | |

| Allstate | $79 | |

| Amica | $92 | |

| Farmers | $92 |

Find Cheap Auto Insurance Quotes Near You

How to calculate your car insurance costs

How to estimate car insurance costs

To estimate the cost of car insurance, you first need to decide what kinds of coverage you need.

The best car insurance coverage for you depends on your budget, your car’s value and your state's minimum requirements.

Review your auto insurance estimates every year to find the cheapest rates and decide if you need different coverage.

The most expensive car insurance coverages are bodily injury liability, collision coverage and comprehensive coverage. Before deciding which insurance coverages to add, compare cost estimates for each coverage type.

Bodily injury liability

Bodily injury liability coverage pays for other drivers' medical costs and lost wages if you cause an accident. It's required in most states, so you usually can't have a policy without it.

Limit per person | Limit per accident | Monthly cost |

|---|---|---|

| $25,000 | $50,000 | $36 |

| $50,000 | $100,000 | $41 |

| $100,000 | $300,000 | $46 |

| $250,000 | $500,000 | $51 |

Property damage liability

Property damage liability covers damage to other people's property if you cause an accident. This includes crashing into another car or object.

Each state has its own requirements for property damage liability, ranging from $5,000 to $25,000.

Limit per accident | Monthly cost |

|---|---|

| $25,000 | $31 |

| $50,000 | $32 |

| $100,000 | $33 |

Uninsured/underinsured motorist bodily injury coverage

Uninsured and underinsured motorist bodily injury coverage covers your medical bills if you're in an accident caused by an uninsured or underinsured driver. It can also cover lost wages and pay for services you can no longer perform yourself, such as cleaning your house or babysitting.

Twenty states require uninsured and underinsured motorist coverage.

Limit per person | Limit per accident | Monthly cost |

|---|---|---|

| $25,000 | $50,000 | $9 |

| $50,000 | $100,000 | $12 |

| $100,000 | $300,000 | $16 |

| $250,000 | $500,000 | $21 |

Comprehensive and collision

Comprehensive and collision coverage are included in a full coverage insurance policy. They cover repairs to your own car for incidents on and off the road, no matter who's at fault.

You'll need this coverage if you have a loan or lease. But it's expensive, often doubling the cost of insurance.

Coverage type | Deductible | Monthly cost |

|---|---|---|

| Collision | $500 | $71 |

| Collision | $1,000 | $56 |

| Comp. | $500 | $11 |

| Comp. | $1,000 | $9 |

What factors are used to calculate your car insurance cost?

Insurance companies calculate your car insurance rate based on a number of factors. For instance, age and accident history are used to determine your "riskiness" as a driver. If you are young or have a ticket, your auto insurance estimates will be more expensive than someone older or with a clean driving record.

Factor | Impact |

|---|---|

| Age | Younger drivers tend to pay more, especially teens. |

| Driving history | You'll usually pay more after a ticket, DUI or accident. |

| Your car | It's cheaper to insure cars that are older, slower or safer. |

| Marital status and dependents | Married people often see a slight discount, but you'll pay much more if a teenager is on your policy. |

| Annual mileage | People who drive less tend to see lower rates. |

How can you get cheaper auto insurance estimates?

To find the most affordable insurance, get quotes from several companies. Also look for discounts for bundling or automatic payments.

- Compare quotes from multiple companies. Car insurance rates can vary by up to $393 per month for full coverage from one company to the next. Get quote estimates from large insurance companies like State Farm and Geico along with smaller ones like Erie and Farm Bureau.

- Look for discounts. Most companies, especially large ones like Geico or State Farm, have a lot of discounts available. These discounts add up to savings of up to 50% off or more, and you may already qualify for many of them.

- If you live with other drivers, consider a multicar policy. It's cheaper to add another person to your insurance plan than to have two separate policies. You can share a multicar policy with anyone you live with.

- Bundle with other insurance. Most major insurance companies offer the option of bundling your home or renters insurance with your auto insurance. Opting for a bundle deal can get you a discount on your total insurance cost for both policies.

- Shop around every year. If your life situation or driving record has changed since you bought your insurance policy, ask your insurance company to see if you qualify for a cheaper quote. Improving your credit score, getting married or staying accident-free might help you save.

Calculate how much auto insurance you need

How much car insurance you need depends first on your state's minimum required coverage.

Most states require:

- $20,000-$25,000 of bodily injury liability insurance per person

- $40,000-$50,000 of bodily injury liability insurance per accident

- $10,000-$20,000 of property damage liability insurance

Some states also require drivers to carry uninsured motorist coverage or personal injury protection (PIP), although this is not the norm. Start with your state's minimum required insurance, then add higher coverage amounts — and maybe other coverage types — based on what you can afford.

How much insurance should you get?

The right amount of auto insurance coverage depends on your budget and driving background. For example, you can typically double your liability coverage limits for a few extra dollars a month.

This can help you avoid expensive bills after a crash, like if you rear-end a Ferrari. On the other hand, if you drive an older car that's not worth much, you probably won't need collision and comprehensive coverage.

Liability insurance

- What is it? Liability insurance pays for damage and injuries to other drivers after an accident where you are at fault.

- Do you need it? Liability coverage is required in every state except New Hampshire.

- How much should you have? State minimums usually aren't high enough to cover the cost of the average accident. However, more coverage will raise your rates.

Comprehensive and collision

- What is it? Collision coverage pays to repair your car after an accident with another car or a stationary object, regardless of who's responsible. Comprehensive coverage pays to repair your car from a cause besides a crash.

- Do you need it? Yes, if you have a loan or lease. Also consider it if your car is expensive or if you couldn't replace it if it was totaled.

- How much coverage should you have? The value of your car, minus your deductible. Choose a deductible based on the amount you would be comfortable paying in an emergency.

Personal injury protection

- What is it? PIP covers the medical costs and lost wages of drivers and passengers after getting into an accident, regardless of who's at fault.

- Do you need it? PIP is required in 12 states. PIP is a good idea if your existing health insurance has high copays or deductibles, or if you want reimbursement for lost wages.

- How much should you have? Your state may require a minimum amount of PIP. Choose an amount that you estimate would cover your out-of-pocket costs for medical care after a major accident.

Uninsured or underinsured motorist

- What is it? Uninsured or underinsured motorist coverage pays for your injuries or repairs if you're hit by a driver who doesn't have insurance or doesn't have limits high enough to pay your bills.

- Do you need it? More than 20 states require drivers to have some form of uninsured or underinsured motorist coverage. Even if your state doesn’t require it, you should still consider purchasing it. It’s affordable, and 1 in 8 drivers do not have car insurance.

- How much coverage should you have? The same limits as your liability coverage for bodily injury and property damage.

The minimum liability requirements may be enough to cover the costs of a minor accident. However, it won’t be enough for repairs after a major accident. Plus, the cost of car repairs has increased 23% in the last year. Consider getting more coverage if you can afford it.

Average claim amounts

Claim type | Average claim amount |

|---|---|

| Bodily injury liability | $20,235 |

| Property damage liability | $4,711 |

| Collision | $3,588 |

| Comprehensive | $1,995 |

Frequently asked questions

How much will my car insurance cost?

The average cost of minimum coverage car insurance in the United States is $58 per month. However, your rates will vary based on where you live, what kind of car you have and your driving history.

How do I calculate the cost of car insurance?

The best way to calculate the cost of auto insurance is to use our online car insurance calculator. By answering three easy questions, you can estimate your car insurance rates based on your location, your car and how much coverage you need.

How much car insurance do I need?

At the very least, you need enough car insurance to meet the minimum legal requirements in your state. However, consider buying more coverage if you drive a lot, have a newer car or are paying off a car loan or lease.

How much should I be paying for car insurance?

How much you should spend on insurance depends on what coverage you need, where you live and your driving history. The average price of car insurance nationwide is $58 per month for a minimum coverage policy and $148 per year for full coverage.

What kind of car insurance should I get?

Nearly every state requires you to have liability insurance, which pays for injuries to other people and property damage. But it's worth it to pay more for full coverage if your car is new or worth more than $5,000, or if you want to avoid unexpected bills.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.