State Farm Medicare Supplement Review: Good Service, but Rates Vary

State Farm Medigap is a good option for Plan G if you live in the Western U.S., but you should compare it to other companies before you buy a plan.

Compare Medicare Plans in Your Area

Pros and cons

Pros

Cheap rates for Plan G in many states

Good customer service

Cons

Doesn't advertise any extra perks

Doesn't offer a household discount

Doesn't sell high-deductible Plan F or G

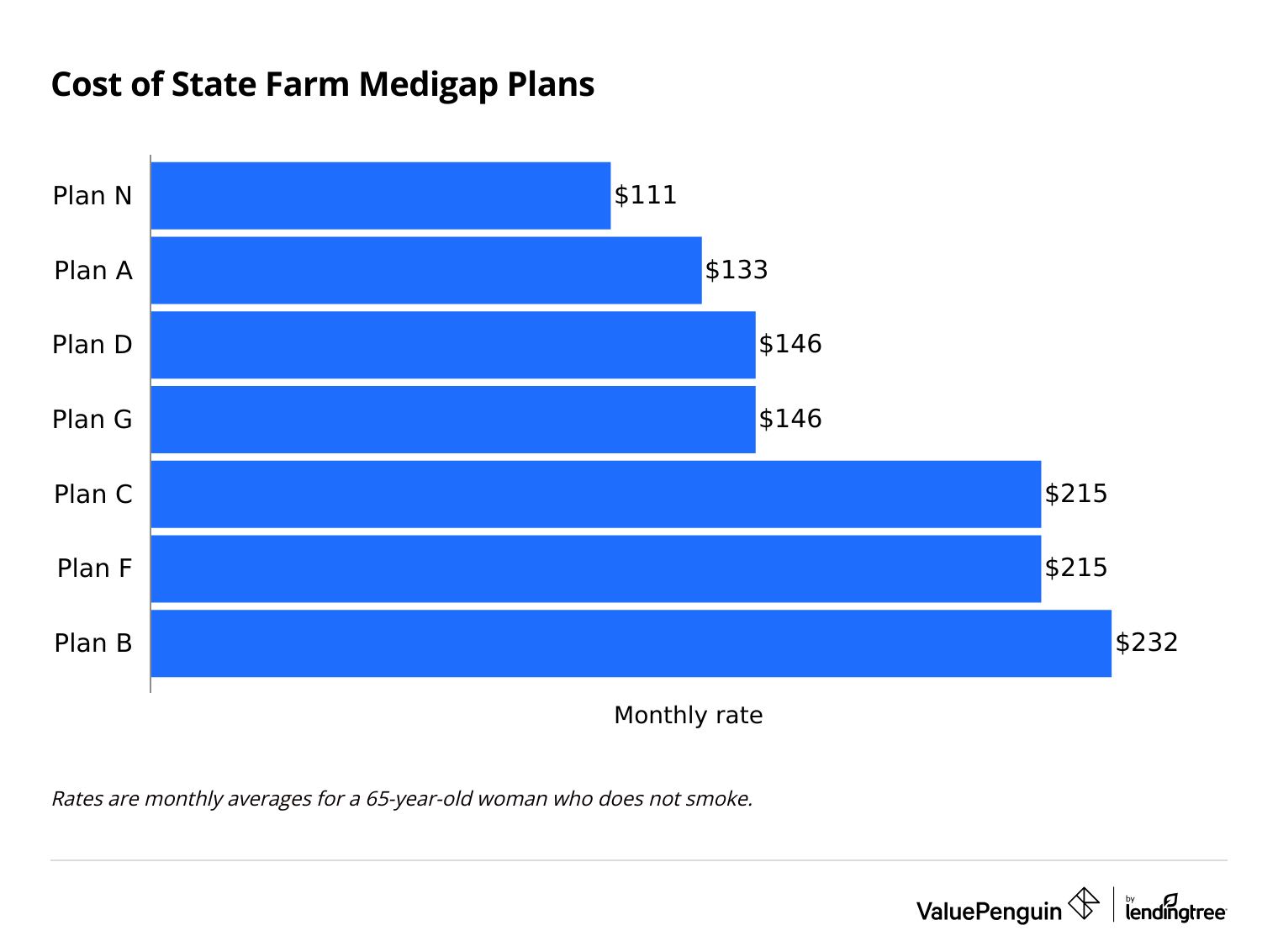

How much does State Farm Medicare Supplement cost?

Plan G from State Farm costs $146 per month, which is about average.

Plan G is the best Medigap plan for most people, unless you became eligible for Medicare before 2020. And State Farm has cheap rates for Plan G in many states. Plan F has more coverage if you qualify, but State Farm's Plan F is expensive.

Plan N is also a popular Medicare Supplement option. State Farm's average rate for Plan N is $111 per month, which is the same as the national average rate.

Compare Medicare Plans in Your Area

Average cost for State Farm Medicare Supplement

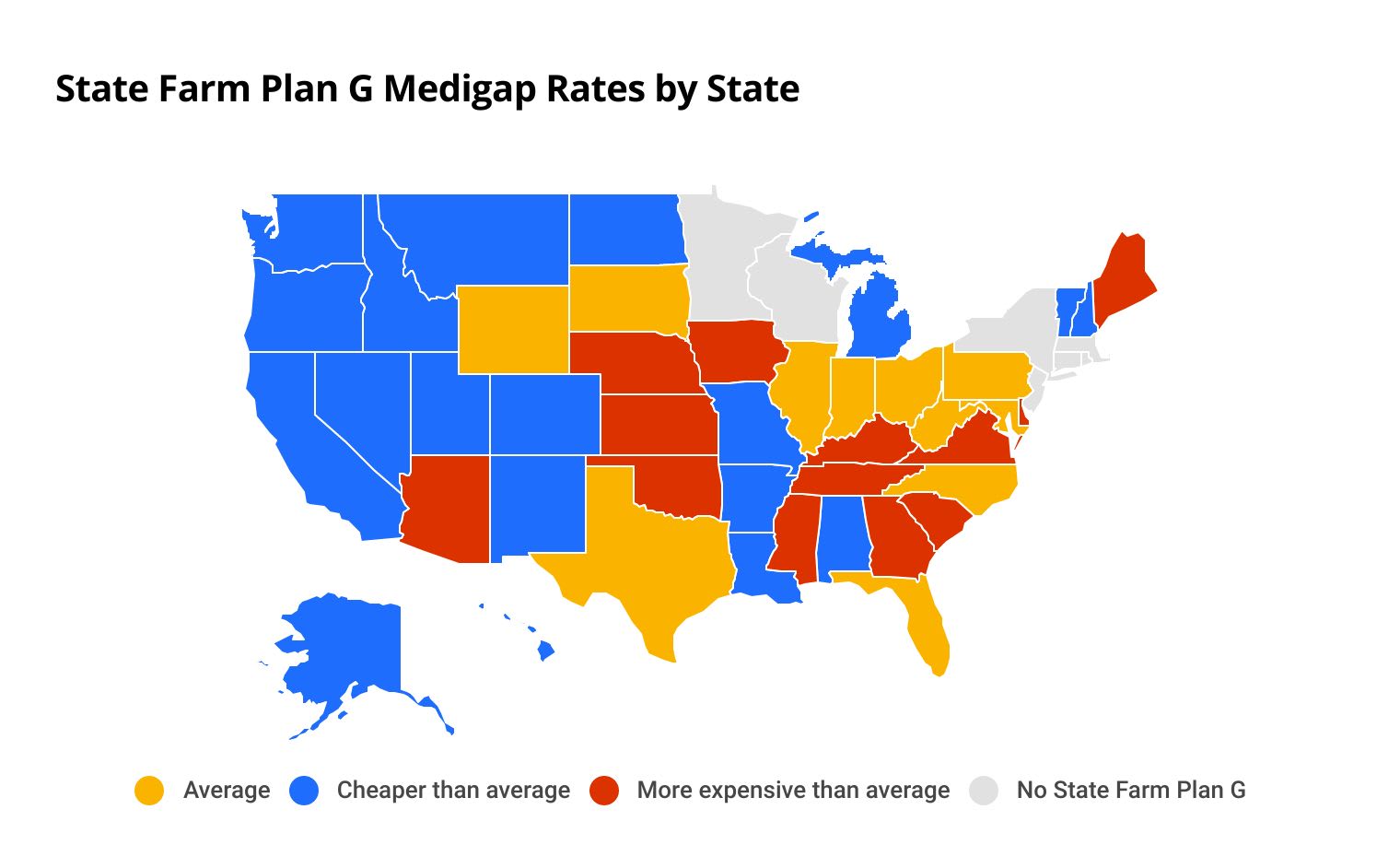

State Farm rates by state

State Farm has cheap rates for Plan G in many states, especially in the western part of the country.

And in several states, State Farm's rates are around the state average. It can make sense to choose State Farm in these states, even over a cheaper option, if you want State Farm's great service.

Compare Medicare Plans in Your Area

State Farm Plan G rates by state

State | State Farm average | State average | Diff |

|---|---|---|---|

| Alabama | $124 | $132 | -$8 |

| Alaska | $111 | $140 | -$29 |

| Arizona | $148 | $139 | +$9 |

| Arkansas | $144 | $161 | -$17 |

| California | $133 | $168 | -$35 |

Average monthly Plan G rates for a 65-year-old woman who does not smoke.

State Farm Medicare Supplement plan options

State Farm sells the most popular Medicare Supplement plans and a few less-popular options.

Overall, State Farm sells seven Medigap plans.

- Plan A

- Plan B

- Plan C

- Plan D

- Plan F

- Plan G

- Plan N

But the plans you can buy depend on where you live. For example, State Farm only sells Plans A, B, C and F in New York. If you live in New York and want Plan G, you'll have to get it from another company.

State Farm also sells plans in Minnesota and Wisconsin. In these states, the Medigap plans are different from the plans in the rest of the country. In Minnesota, State Farm sells the Basic plan and in Wisconsin, it sells the Base plan.

State Farm Medicare Supplement perks and benefits

State Farm doesn't advertise any optional features or perks for its Medigap plans.

Many other companies, including AARP and Blue Cross Blue Shield include some extras with their Medicare Supplement plans, like nurse call lines and rewards for healthy living.

State Farm also doesn't give you a discount if more than one person in your house buys a plan. This is called a "household discount," and it can save you up to 20% on your Medicare Supplement policy. Most major Medigap companies offer a household discount, but State Farm doesn't.

State Farm Medigap customer service and reviews

People are usually satisfied with State Farm's customer service for its Medigap plans.

State Farm gets 26% fewer complaints about its Medigap plans than expected for a company its size, according to the National Association of Insurance Commissioners. This means that overall, people who have a State Farm Medigap plan don't have issues with the company's service.

State Farm's good service might be in part because of its local agents. You can get a quote for State Farm Medigap online, but you have to work with a local agent to buy the policy. A local agent can guide you and help you feel confident that you're picking the right Medigap plan for your needs.

Frequently asked questions

Does State Farm offer Medicare Supplement insurance?

State Farm sells Medicare Supplement plans, also called Medigap plans, in 46 states and Washington, D.C. It doesn't sell plans in Connecticut, New Jersey, Rhode Island or Massachusetts. State Farm sells Medicare Supplement Plans A, B, C, D, F, G and N, but the plans you can get depend on where you live.

Is State Farm Medicare Supplement good?

State Farm Medigap plans can be a good option depending on where you live. The company has great customer service, but its rates aren't always the best. Get a quote for the Medigap plan you're interested in and compare it to other companies in your area to decide if State Farm is a good fit.

How much is State Farm Medicare Supplement Plan G?

Overall, Plan G from State Farm costs $146 per month, which is about average. But the rates change based on where you live. In Alaska, Plan G from State Farm is just $111 per month. But in Maine, State Farm's Plan G is $261 per month. State Farm sells Plan G in 43 states and Washington, D.C., and its rates are cheaper than average in 19 states and D.C.

Methodology and sources

ValuePenguin used actuarial data from private insurance companies to find average rates for State Farm Medigap plans, as well as the average rates for Medigap plans across different states. Rates are for a 65-year-old woman who bought her policy when she was first eligible and who does not smoke. Customer satisfaction data is from the National Association of Insurance Commissioners (NAIC).

Our experts created a star rating for State Farm Medicare Supplement based on the company's average rates, plan options, customer satisfaction and perks.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.