How Much Does Tesla Insurance Cost? Rates by Model

The average cost of car insurance for a Tesla is $3,947 per year, or $329 per month.

Find Cheap Tesla Insurance Quotes in Your Area

Teslas are more expensive to insure than other cars because they cost a lot to repair.

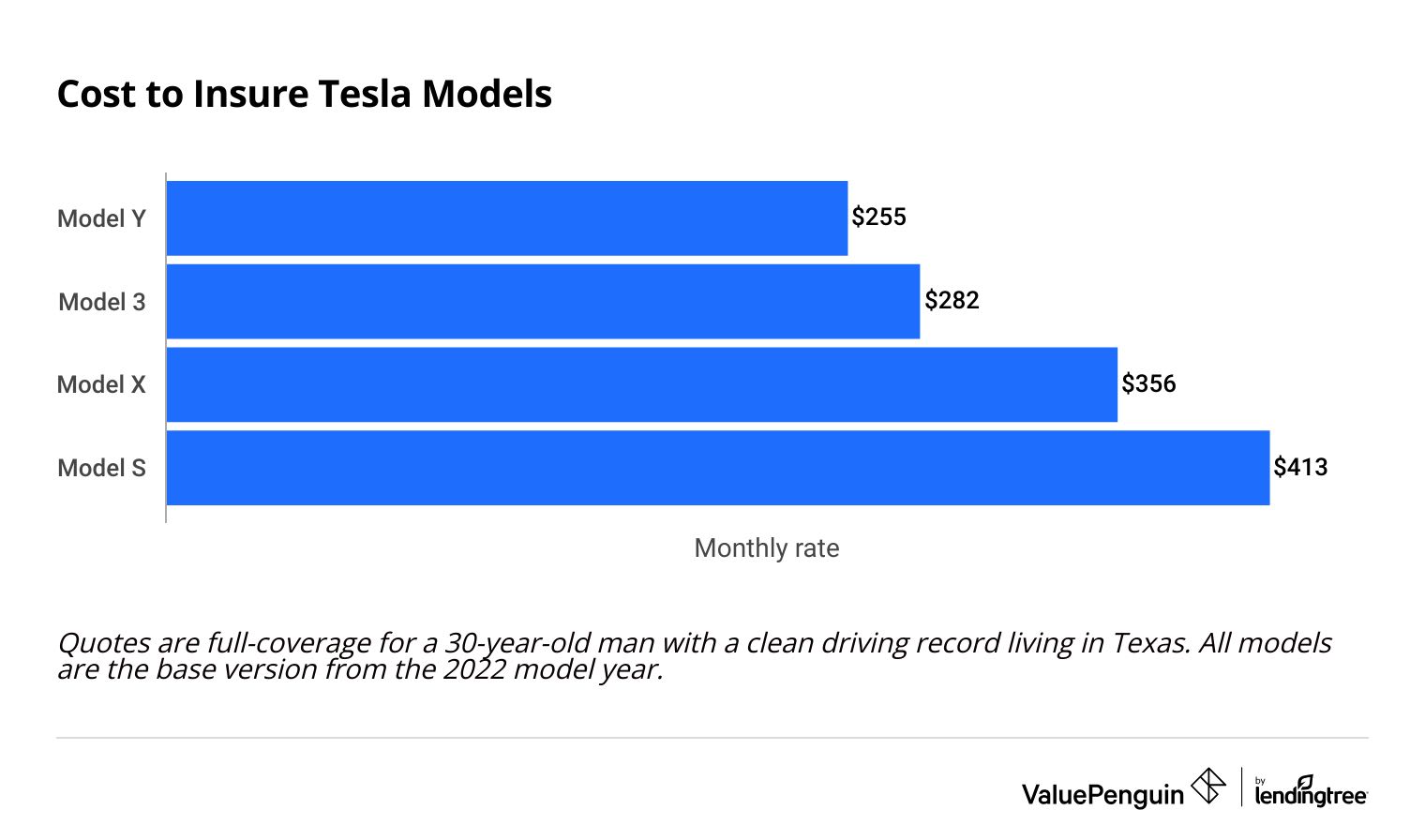

Cost by model:

Should I get insurance directly from Tesla?

Tesla sells its own insurance, and its rates are very competitive for good drivers. It sets prices primarily using sensors onboard your Tesla, and ignores things like credit score, speeding tickets or claim history.

But that means your rates can change a lot from month to month, and the company gets lots of complaints from customers who aren't happy with the service they receive. It's also only currently available in 12 states .

How much is Tesla insurance?

The average cost to insure a new Tesla is $329 per month. The Model Y, is the cheapest model to insure.

Find Cheap Tesla Insurance Quotes in Your Area

Model | Monthly cost |

|---|---|

| Model Y | $255 |

| Model 3 | $282 |

| Model X | $356 |

| Model S | $413 |

The cost of Tesla insurance varies a lot based on which insurance company you choose, as well the model and trim.

While it's not the most affordable Tesla to buy, the Model Y is a crossover that's slightly cheaper to cover than the Model 3. Crossover cars tend to have the cheapest insurance rates.

The most expensive Tesla to insure is the Model S, at an average cost of $413 per month for the base model.

Tesla insurance: rates by model

While the average cost to insure a new Tesla vehicle is $329 per month, the price varies a lot by model. The cheapest Tesla to insure is the Model Y, which has an average rate of $255 per month.

Model 3

The Model 3 sedan is Tesla's least expensive model to buy, currently starting at $38,990 before incentives or add-ons. But the cost to insure is still fairly expensive, at $282 per month for the newest base model.

Choosing either of the more expensive Model 3 trims, which have larger batteries and higher maximum speeds, can raise your insurance bill slightly.

Average cost of car insurance for Tesla Model 3

Model year | Trim | Monthly rate |

|---|---|---|

| 2022 | Standard Plus | $282 |

| 2022 | Long Range | $301 |

| 2022 | Performance | $313 |

| 2021 | Standard Plus | $277 |

| 2020 | Standard Range Pl | $267 |

Model Y

The Model Y is the cheapest Tesla to insure, with an average rate of $255 per month for the base trim. That's 13% less than the average rate across all new Teslas.

The Model Y is a compact crossover vehicle. These types of cars tend to have the most affordable rates compared to smaller sedans or larger, more expensive, full-size SUVs.

Average cost of car insurance for Tesla Model Y

Model year | Trim | Monthly rate |

|---|---|---|

| 2022 | Long Range | $255 |

| 2022 | Performance | $279 |

| 2021 | Standard Plus | $236 |

| 2020 | Long Range | $253 |

Model S

Tesla's first mass-produced vehicle, the Model S, is also its most expensive to insure, with an average rate of $413 per month. The Model S starts at $94,990 without discounts or add-ons.

Surprisingly, the high-end Model S, with a top speed of 175 MPH, is less expensive to insure than the base model — though only by about $8 per month.

Average cost of car insurance for Tesla Model S

Model year | Trim | Monthly rate |

|---|---|---|

| 2022 | Long Range | $413 |

| 2022 | Plaid | $405 |

| 2021 | Long Range | $405 |

| 2020 | Long Range | $395 |

| 2019 | — | $383 |

Model X

The Model X, Tesla's high-end, full-size SUV, costs an average of $356 per month to insure. That's $759 more than the typical price across all models.

The cheapest insurer for the Model X is Tesla's own insurance program, which offers a typical rate of $175 per month.

Average cost of car insurance for Tesla Model X

Model year | Trim | Monthly rate |

|---|---|---|

| 2022 | Long Range | $356 |

| 2022 | Plaid | $356 |

| 2021 | — | $318 |

| 2020 | Long Range | $337 |

| 2019 | — | $323 |

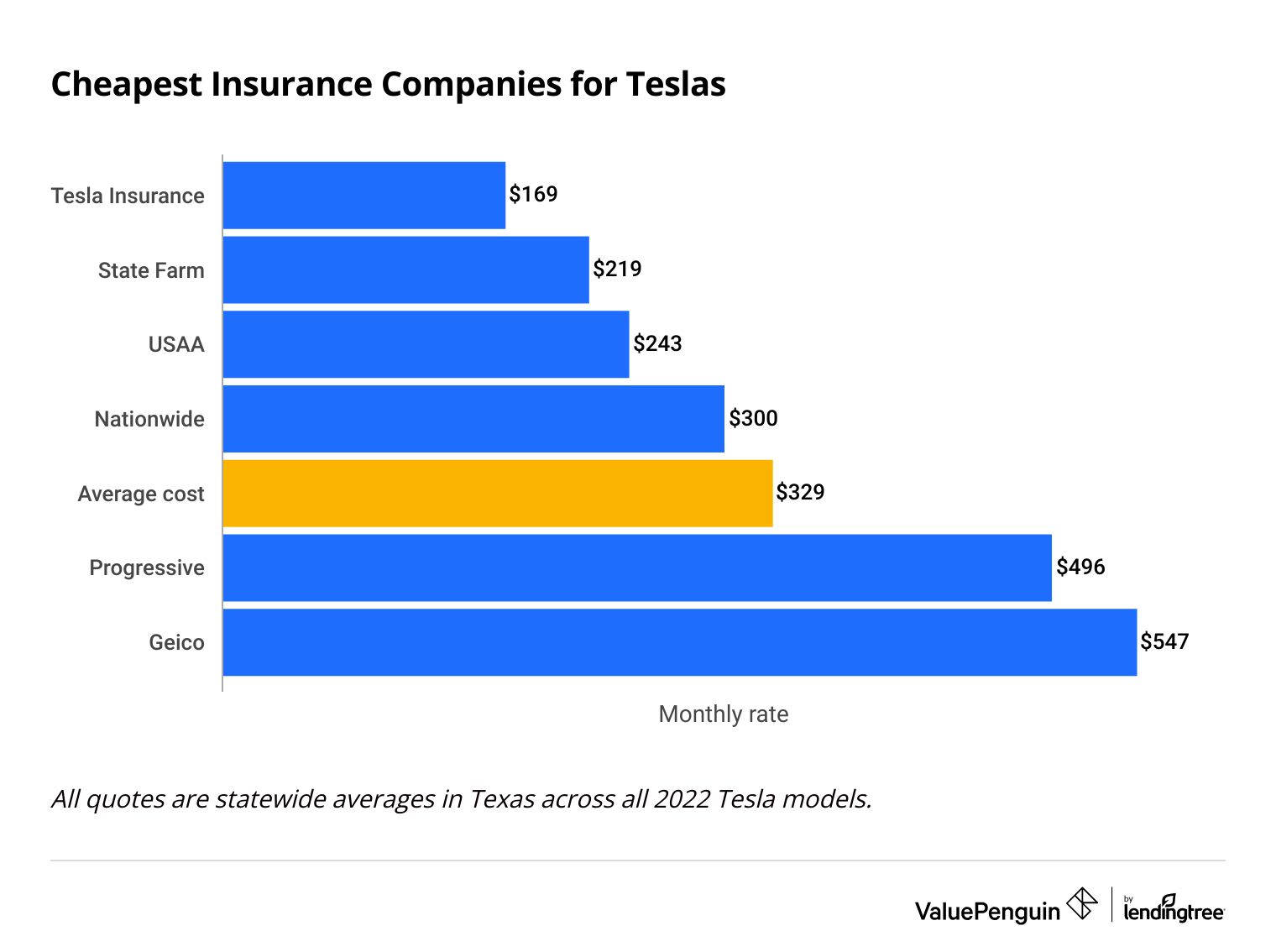

Which companies offer the cheapest insurance for a Tesla?

Compared to the largest national insurance companies, Tesla Insurance has the cheapest auto insurance rates to insure a Tesla in Texas, at an average rate of $169 per month for a new Tesla. That's half the average rate.

State Farm is the second-cheapest company and the most affordable among major insurers, with an average monthly rate of $218.

Find Cheap Tesla Insurance Quotes in Your Area

Average full coverage car insurance quotes for Teslas

Company | Monthly rate | |

|---|---|---|

| Tesla Insurance | $169 |

| State Farm | $219 |

| USAA | $243 |

| Nationwide | $300 |

| Progressive | $496 |

To make sure you get the most affordable Tesla insurance rates, get free online quotes to compare car insurance rates from different companies.

Tesla Insurance program review

Tesla's insurance program is only available to people who own Tesla cars, but you can insure a non-Tesla vehicle there as well.

Tesla's own insurance rates are substantially cheaper than other companies. The typical rate is $169 per month across all new Tesla models — that's 49% less than the average rate.

Rates in every state except California are primarily set using Tesla's own "Safety Score," with little to no consideration for tickets, recent claims or your credit score.

Tesla drivers with high Safety Scores can see even more savings. A perfect score of 100 typically saves you 37% off the base rate.

Unlike most insurance companies, Tesla does not consider any of the following factors when setting car insurance rates:

- Accident history

- Tickets (such as speeding)

- Claims

- Credit

- Age

- Gender

- Marital status

However, Tesla's exclusive use of its onboard sensors means that a single incident, even if it's not your fault, can impact your rates. Customers have reported another driver unexpectedly pulling in front of them leading to price increases of $10 or more for next month's premium.

Tesla Insurance also gets a lot of complaints from its customers, suggesting drivers are often unhappy with the service they receive. Tesla Insurance receives nearly six times as many complaints as a typical car insurance company.

Where is Tesla Insurance available?

Tesla's car insurance is available exclusively to Tesla owners in 12 states.

- Arizona

- California*

- Colorado

- Illinois

- Maryland

- Minnesota

- Nevada

- Ohio

- Oregon

- Texas

- Utah

- Virginia

Extra Tesla coverage options

You can add the Autonomous Vehicle Protection Package to cover:

- Autonomous vehicle owner liability

- Electronic key replacement

- Cyber identity fraud expenses

- Wall charger coverage

Tesla Insurance rates by Safety Score

While Tesla's insurance rates are very affordable for nearly all drivers, your rate drops even more if you have a high Safety Score.

A perfect score of 100 will get you a monthly rate of just $74 on a new Model 3. That's shockingly low compared to the overall average of $282 per month

Tesla adjusts rates according to five-point Safety Score increments. So if your average score falls between 95 and 99, your rate will increase to $87 per month

How does the Tesla Safety Score work?

Tesla's Safety Score works much like other telematics car insurance like Progressive Snapshot. The Tesla app monitors your driving habits and assigns a score between 0 and 100, with most drivers getting an 80 or above.

The biggest difference is that your score is the only thing Tesla considers when setting rates, so your actions have a big impact on what you pay each month.

Unlike many other telematics systems, Tesla is specific about what causes your score to go down:

- Forward collision warnings (per 1,000 miles)

- Hard braking (percent of time)

- Aggressive turning (percent of time)

- Unsafe following time (percent of time)

- Forced autopilot disengagement (number of instances)

Your Safety Score is calculated daily, and a weighted average based on driving time is calculated over the last 30 days.

Average monthly Tesla Insurance rates by Safety Score

Safety Score | Monthly rate |

Difference from average

|

|---|---|---|

| 100 | $74 | -25% |

| 95-99 | $87 | -12% |

| 90-94 | $91 | -8% |

| 85-89 | $95 | -4% |

| 80-84 | $99 | — |

Rates are for a 2022 Tesla Model 3 in Texas.

Tesla Insurance rates in California

Tesla Insurance in California works differently than Tesla Insurance in other states because the California rates aren't based on your Safety Score.

However, Tesla's own insurance program is still the most affordable option available in the Golden State. Its average price across all 2022 Tesla models is $187 per month. That's 45% less than the state average, and $81 per month cheaper than the second-best option, Geico.

Average full coverage Tesla quotes in CA

Company | Monthly rate | |

|---|---|---|

| Tesla Insurance | $187 |

| Geico | $268 |

| State Farm | $320 |

| Farmers | $327 |

| California average | $338 |

Why are Teslas so expensive to insure?

Tesla cars are expensive to insure because they are expensive to buy and repair. They're even more expensive to insure compared to other electric cars.

- Teslas can only be repaired at Tesla-approved body repair shops. The training and equipment to become qualified means much higher costs for drivers.

- Electric cars are more expensive to repair and insure because they have more expensive equipment and technology.

- Teslas have a longer battery range than other EVs, so they tend to rack up more miles. More driving time means higher crash risks.

- The Model S aluminum frame is more expensive and difficult to repair than a steel frame.

That's why the cost to repair a Tesla, even for a minor fender bender, can easily reach several thousand dollars. As the cars include more custom parts, safety features and technology, the cost per collision may continue to rise.

Quotes for a Tesla also factor in the cost of replacing the car's high-end tech after a crash.

Frequently asked questions

How much does insurance cost for a Tesla Model 3?

The average cost to insure a Model 3 is $282 per month for full coverage. It's cheaper to insure than a Model S or Model X, but more expensive than the Model Y ($255 per month).

Is Tesla's insurance program cheaper than other insurers?

Tesla's in-house insurance program is very affordable compared to other insurers — it's the cheapest option in Texas. However, it's currently only available in 12 states.

Methodology

All car insurance quotes are for a full coverage policy for a 30-year-old driver with good credit. Unless otherwise stated, rates are statewide averages in Texas.

ValuePenguin's analysis used insurance rate data from Quadrant Information Services. These rates were publicly sourced from insurer filings and should be used for comparative purposes only. Your own quotes may be different.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.