What Is Medicare? Who Qualifies and How Does It Work?

Compare Medicare Plans in Your Area

Medicare is government health insurance for those age 65 and up, and people with certain illnesses.

You automatically get Medicare when you start collecting Social Security benefits. Younger people can enroll in Medicare if they've collected Social Security Disability payments for 24 months, or if they have kidney failure or Lou Gehrig’s disease. Medicare is broken into four parts: A, B, C and D.

What is Medicare?

Medicare is a health insurance program run by the federal government. It's broken down into several parts.

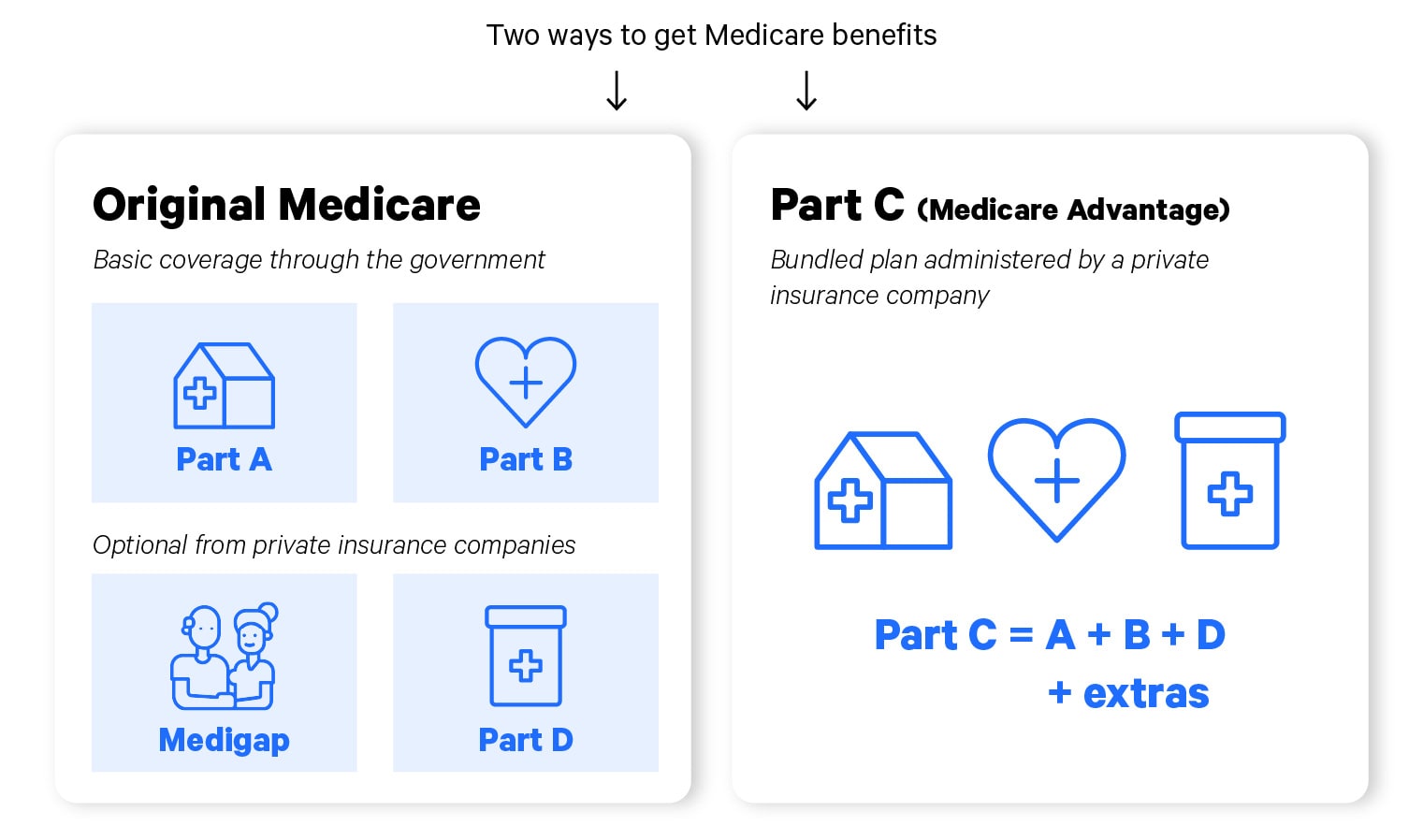

Types of Medicare insurance

- Medicare Part A: Hospital and skilled nursing facility stay (inpatient care).

- Medicare Part B: Preventive care and visits to the doctor (outpatient care).

- Medicare Part C: Bundled coverage from private companies that includes Part A and B coverage. Also often pays for prescription drugs, vision and dental.

- Medicare Part D: Prescription drug plans sold by private companies.

- Medicare Supplement (Medigap): Covers some or all of the costs that you're responsible for paying with Original Medicare (Parts A and B).

Most people will automatically get Medicare when they turn 65. Medicare Part A is free as long as you or a spouse has paid Medicare taxes for at least 10 years. Medicare Part B has a monthly rate of $185 per month in 2025.

You may have to pay more if you make $106,000 per year or more ($212,000 for a married couple). The extra cost is called your income-related monthly adjustment amount (IRMAA).

Medicare is designed to cover 80% of your medical costs. You can buy a Medicare Supplement (Medigap) plan to help cover your remaining costs.

What does Medicare pay for?

Medicare Part A (hospital insurance) pays for expenses when you're staying in a medical facility like a hospital or hospice. Medicare Part B (medical insurance) pays for you to visit the doctor. It also pays for preventive services like annual flu shots and checkups.

Regular Medicare typically won't pay for hearing, vision and dental care. It also won't cover overseas medical care and cosmetic surgery.

Medicare Advantage plans usually offer dental, vision and hearing coverage in addition to what's covered by regular Medicare.

Medicare vs. Medicaid

Both Medicare and Medicaid are government-run health insurance programs. However, while Medicare is mostly for people age 65 and older, Medicaid is for people who earn a low income.

You can qualify for Medicare and Medicaid if you meet the eligibility requirements for both programs.

Who qualifies for Medicare?

You're eligible for Medicare if you're 65 years old or older and a U.S. citizen or a permanent resident for at least five years. In addition, you automatically qualify for Medicare if you have end-stage renal disease (kidney failure) or Lou Gehrig’s disease (ALS).

You also qualify for Medicare after getting Social Security Disability payments for two years.

Types of Medicare

Medicare is divided into four different parts. Each part of Medicare covers different medical services, except for Part C, which bundles together coverage from the other three parts.

It's important to understand how each part of Medicare works since the plan you choose will have a big impact on your coverage, the customer experience and the network of doctors you'll have access to.

Original Medicare (Parts A and B)

Original Medicare is made up of Medicare Part A (hospital stays) and Part B (doctor visits). Most people will automatically be signed up for Original Medicare when they turn 65 and start getting Social Security benefits.

Consider Original Medicare if having flexibility when it comes to doctors is very important to you. Roughly 99% of doctors accept Original Medicare nationwide. By contrast, Medicare Advantage plans typically limit you to a network of doctors.

Original Medicare costs

You'll pay $185 per month for Medicare Part B in 2025. You also need to pay a $257 deductible before Medicare Part B starts paying for care. Part A has a separate $1,676 deductible.

Both Medicare Part A and B have copays and coinsurance, so you will pay something when you go to the doctor, even after your deductible.

Medicare Advantage (Part C)

Medicare Advantage (Part C) plans offer bundled coverage that must include everything offered by Medicare Parts A and B. In addition, many Medicare Advantage plans have extra benefits such as prescription drug, vision and dental coverage, and fitness programs like SilverSneakers.

Unlike Original Medicare, Medicare Advantage plans are sold by private companies. The government gives money to these companies based on how many people sign up for their plans. That's why many Medicare Advantage plans don't charge a monthly rate.

More than half of all people on Medicare are enrolled in a Medicare Advantage plan.

Unlike Original Medicare, which lets you see almost any doctor nationwide, Medicare Advantage plans typically limit you to a network of doctors. Most Medicare Advantage plans are HMOs (health maintenance organizations) or PPOs (preferred provider organizations).

That means if you pick a Medicare Advantage plan, you're typically trading flexibility for more coverage.

Medicare Part D (prescription drug coverage)

You can get prescription drug coverage through Medicare Part D if you have regular Medicare. You can't buy a Part D plan if you have Medicare Advantage. However, most Medicare Advantage plans come with prescription drug coverage.

The average Medicare Part D plan costs $65 per month in 2025.

It's important to keep in mind that Part D plans vary in cost and coverage. Check your plan's list of covered drugs, called a formulary, before you sign up. Otherwise, you might end up with a plan that doesn't cover your prescriptions.

Medicare Supplement (Medigap)

Original Medicare won't pay for all of your medical costs. Medicare Supplement plans help you cover the part of your medical bill that you're responsible for paying.

Medigap plans are standardized by plan letter. That means coverage doesn't change between companies. A Plan F policy from Humana will have the same coverage as a Plan F policy from Blue Cross Blue Shield.

That means you should pay the closest attention to cost and customer service when shopping for a Medicare Supplement plan.

Although you can choose from 10 different plans, most people choose from the three plan options that offer the most coverage: F, G and N. Plan F offers the greatest level of coverage. However, you can only buy it if you became eligible for Medicare before 2020.

Plan G is the most popular choice for new Medicare enrollees.

It has the same coverage as Plan F, except it doesn't pay for your $257 Part B deductible. In some cases, a Plan G policy is at least $257 per year cheaper than a Plan F policy, making Plan G the better option overall.

Medigap Plan N offers the same coverage as Plan G, except Plan N has up to a $20 copay for doctor visits and up to $50 copays for emergency room visits. Plan N also doesn't cover excess charges.

Enrolling in Medicare

You can only enroll in Medicare or switch plans during specific parts of the year.

If you start getting Social Security benefits at age 65, the government will automatically enroll you in Original Medicare (Parts A and B). You don't need to do anything else for this to happen. You'll get your Medicare card three months before your coverage begins, and the government will automatically deduct your Medicare Part B rate from your Social Security benefits.

However, if you've chosen to put off your Social Security benefits, you'll have to sign up for Medicare online, over the phone or at your local Social Security office within three months of your birthday month. This is called your initial enrollment period.

If you miss your initial enrollment period, you'll have to wait until Medicare open enrollment, which runs from Oct. 15 to Dec. 7.

Medicare late enrollment penalty

You'll have to pay a late enrollment penalty if you miss your initial enrollment period. This penalty is added to your monthly rate and continues for as long as you have Medicare.

There are some exceptions to this rule. For example, if you delayed Medicare enrollment because you had health coverage through your or a spouse's workplace, you may qualify for what's called a special enrollment period. This lets you enroll in Medicare at any time of the year without penalty.

Medicare enrollment periods

It's important to keep track of when you're allowed to enroll or switch Medicare plans. Trying to enroll outside of these periods may result in penalties or denied coverage.

- Medicare initial enrollment period runs from three months before the start of your birthday month to three months after the end of your birthday month.

- Medicare open enrollment happens between Oct. 15 and Dec. 7 each year. During this time, you can sign up for Medicare if you missed your initial enrollment period. You can also drop, add or switch Medicare Advantage plans.

- Medicare special enrollment periods are when you can change insurance because of a major life change, such as a move or losing another type of health coverage.

- Medicare Advantage enrollment starts on Jan. 1 and runs to March 1. During this time, you can switch Medicare Advantage plans, or drop your Medicare Advantage plan for Original Medicare and Part D.

Medicare Supplement (Medigap) plans don't have an open enrollment period. You can buy or switch Medigap plans at any time. However, you'll get the best deal if you buy a Medigap plan within six months of becoming eligible for Medicare, or within 63 days of losing your existing coverage.

You may have to pay a higher rate for coverage if you try to buy a plan after this period.

Frequently asked questions

What is Medicare?

Medicare is government-run health insurance that's available to people aged 65 and older, and younger people who've gotten Social Security Disability payments for two years or who have kidney failure (end-stage renal disease) or ALS (Lou Gehrig’s disease).

How does Medicare work?

Most people automatically get Medicare when they turn 65 and start taking Social Security payments. You can choose between Original Medicare (Parts A and B) and Medicare Advantage, which is run by private companies. Original Medicare gives you access to a broader network of doctors, but Medicare Advantage plans typically offer more coverage.

Is Medicare free?

No, most people need to pay $185 per month for Medicare Part B. Medicare Part B has a $257 deductible, Part A has a $1,676 deductible and both Medicare Part A and B have copays and coinsurance, which you're responsible for paying.

Sources and methodology

Medicare rules and plan limit information is from Medicare.gov, the Social Security Administration (SSA) and the Centers for Medicare & Medicaid Services (CMS). Medicare Advantage denial statistics came from the U.S. Department of Health and Human Services.

Medicare Advantage enrollment numbers are from KFF.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.