Best Cheap Medicare Advantage Plans in Tennessee

Compare Medicare Plans in Your Area

Amerigroup has the best Medicare Advantage plans in Tennessee because of its cheap rates and good coverage quality.

BlueCross BlueShield (BCBS) of Tennessee has the highest-quality plans, but the average monthly rate is expensive. If you're looking for a plan that costs nothing, Aetna is a good choice. A Medicare Advantage plan in Tennessee costs an average of $22 per month, but everyone has access to a plan that has no monthly rate.

ValuePenguin chose the best Medicare Advantage plans in Tennessee after reviewing average rates, availability, coverage and customer satisfaction. Only HMO and PPO plan networks were considered because they are the most commonly offered types of plans. To assess coverage quality and customer satisfaction, we used the rating system from the Centers for Medicare & Medicaid Services (CMS). Companies with a higher CMS star rating have higher-quality plans and better customer satisfaction.

Compare the best cheap Medicare Advantage plans in Tennessee

The best cheap Medicare Advantage plans in Tennessee come from Amerigroup.

The company has cheap average rates, good-quality coverage and high customer service ratings. It's also available to everyone in Tennessee who is eligible for Medicare.

The highest-rated company is BlueCross BlueShield of Tennessee, but its plans are also the most expensive in the state. If you want a no-cost plan, Aetna's options are the best. Not all of its plans have a $0 monthly rate, though.

Company | Monthly cost | CMS rating | |

|---|---|---|---|

| Ascension Complete | $0 | Not yet rated | |

| Clover Health | $0 | ||

| Farm Bureau Health Plans | $0 | Not yet rated | |

| Devoted Health | $4 | Not yet rated |

| Wellcare | $4 | |

There are two main types of health insurance networks: HMOs and PPOs. With an HMO, you have to have a primary care physician, and you need a referral before seeing a specialist. You also have to use doctors in the plan's network or you won't have any coverage. With a PPO, you can see a specialist without a referral, which can make it easier and faster to get medical care. You can also see any doctor and still have coverage, although you'll pay more for your medical care if you go to an out-of-network doctor.

Amerigroup: Best cheap plans

-

Star rating

-

Monthly rate

$7 ?

Why it's great

- Has cheap average rates

- Is available across Tennessee

- Has above-average customer service

Amerigroup's Medicare Advantage plans are cheap and have better-than-average service ratings.

Amerivantage Choice is a good option from Amerigroup if you take prescription drugs. You have coverage for your medications immediately because the plan doesn't have a drug deductible. Amerivantage Choice uses a PPO network, which gives you the flexibility to see any doctor without a referral. PPOs are usually more expensive than other types of coverage, but the Amerivantage Choice plan has no monthly cost.

Amerigroup sells Medicare Advantage policies under three names in Tennessee: Amerigroup, Amerigroup Community Care and Amerigroup Insurance Co. Amerigroup customers are typically satisfied with the company's service and report that the company does a good job helping them get the medical care they need. CMS gives Amerigroup four out of five stars in the customer service category.

However, Amerigroup only gets two stars for its Special Needs Plans in Arizona, which offer specialized coverage to certain groups. If you need a Special Needs Plan, Humana and UnitedHealthcare are better options.

If you have extensive medical needs, Amerivantage Balance Plus is a good option. If you use the plan often, you'll only pay up to $4,900 each year for your medical expenses. That's the lowest out-of-pocket maximum that Amerigroup offers. Amerivantage Balance Plus has an average monthly cost of $9. The plan uses an HMO network, so you have to use in-network providers to have coverage.

BlueCross BlueShield of TN: Highest-rated plans

-

Star rating

-

Monthly rate

$77 ?

Why it's great

- Has the highest coverage quality in Tennessee

- Is available to everyone in the state

- Sells two plans with no monthly fee

BlueCross BlueShield of Tennessee sells five Medicare Advantage plans, all of which have the best quality rating possible.

BlueAdvantage Sapphire is the best option from BCBS of TN if you want a $0 Medicare Advantage plan and high-quality coverage. The plan covers your prescription drugs immediately. It also comes with several extra perks, including vision, dental and hearing coverage. If you have high medical costs, though, it might not be the best option. Other companies have lower out-of-pocket maximums than the Sapphire plan's $5,337.

BlueCross BlueShield of Tennessee has high monthly rates. Plans cost an average of $77 per month, which is 81% more than the state average. Cheaper plans are available, though. BlueAdvantage Sapphire and BlueAdvantage Garnet both have no monthly fee and are available to about half of Tennessee's Medicare-eligible population.

If you need a lot of medical care, it might be worth it to pay for the BlueAdvantage Diamond plan. The plan costs an average of $171 per month and is the most expensive in the state. But if you use in-network doctors, you'll only pay up to an average of $3,283 toward your medical bills. Even though the plan is expensive, it can help you save money if you need complex or frequent medical care.

Aetna: Best $0 plans

-

Star rating

-

Monthly rate

$9 ?

Why it's great

- Sells two plans with no monthly rate

- Is available to over half the population

- Has high-quality coverage

Aetna's no-cost plans have good coverage, but not all of its plans are free.

Aetna sells two Medicare Advantage plans in Tennessee that don't have a monthly fee: Premier and Premier Plus. The plans are similar, but Premier Plus has lower copays for in-network specialists and urgent care locations. The Premier Plus plan could also let you pay less for your medical bills since it has a lower in-network deductible. Notably, both plans are PPOs, which gives you the flexibility to choose your doctors and to go to specialists without referrals.

About 66% of people eligible for Medicare in Tennessee can buy an Aetna plan. The company's plans are not available in the eastern part of the state or around Jackson and Lexington. If you live in one of these areas, consider the AARP Medicare Advantage Plan 1 or AARP Medicare Advantage Plan 2 from UnitedHealthcare. These plans are more widely available than Aetna's options, but they restrict you to a doctor network.

Aetna offers a long list of added benefits, including a 24/7 nurse line, prescription home delivery and a gym membership through SilverSneakers. The company also has better coverage quality and customer satisfaction than the companies that only sell no-cost plans. Aetna makes it easy to set medical appointments and get appropriate care, according to the company's CMS star rating.

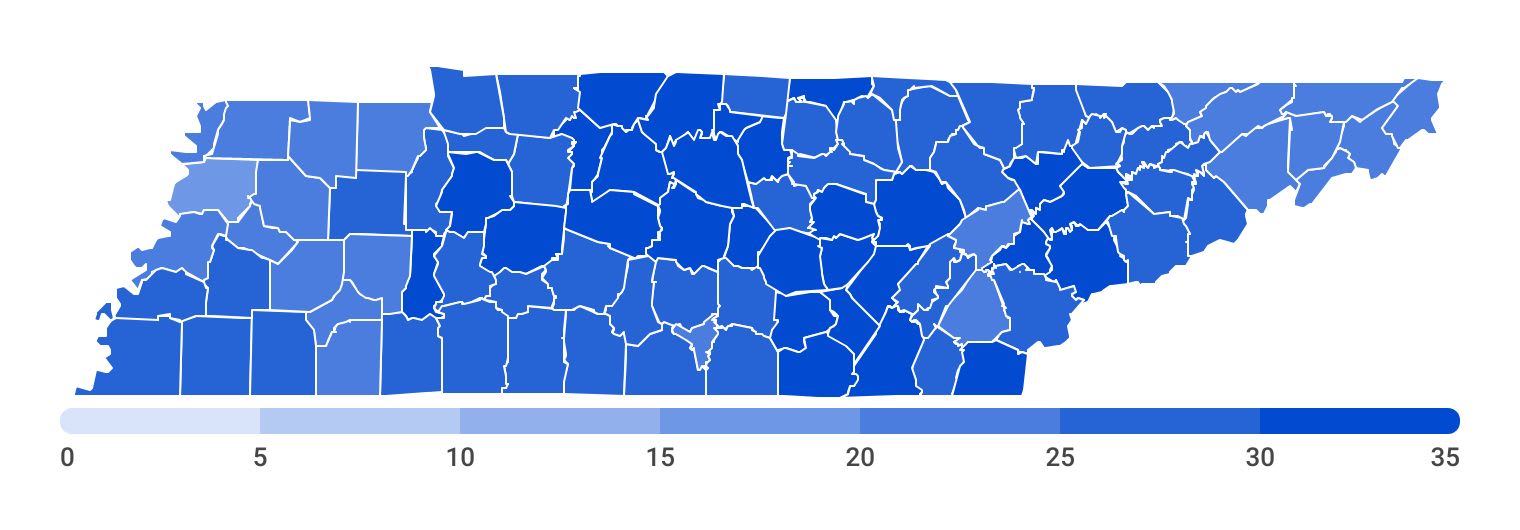

Medicare Advantage availability in Tennessee

Most Tennessee residents can choose from a variety of Medicare Advantage plans. Even in rural counties, Tennessee residents have more plan options than people in other states, like California and Florida.

Number of Medicare Advantage plans per county in Tennessee

Compare Medicare Plans in Your Area

If you live near the Nashville metropolitan area, you'll have nearly 40 plans to choose from. If you live near the Missouri border in the northwest part of the state, you'll have the fewest Medicare Advantage plans available. But you'll still be able to choose from 18 plans, which is a lot compared to counties in other states.

Number of Medicare Advantage plans by Tennessee county

Tennessee county | Number of Medicare Advantage plans |

|---|---|

| Anderson | 30 |

| Bedford | 27 |

| Benton | 27 |

| Bledsoe | 30 |

| Blount | 30 |

Tennessee Medicare enrollment statistics

- Medicare-eligible residents in Tennessee: 1,410,171

- Medicare Advantage enrollees in Tennessee: 676,882

- Number of Medicare Advantage companies in Tennessee: 11

- Average monthly cost of Medicare Advantage in Tennessee: $22

How to choose a Tennessee Medicare Advantage plan

No matter where you live in Tennessee, you have several Medicare Advantage plans to choose from. Comparing the plans lets you see which option best fits your needs.

Review your needs: Your health status is the most important part of choosing the best Medicare Advantage plan. For example, if you take prescription drugs, you may want to buy a plan without a drug deductible. If you go to the doctor often, choose a plan with a low copay.

Get quotes: Once you've identified which plans might work for you, get quotes for each. This lets you review the monthly rate and see if it fits in your budget. You can also compare the plan's features, like how much you pay when you see a doctor.

Look for extra benefits: Most Medicare Advantage plans have extra benefits. Common benefits include coverage for vision checks, regular dental care and hearing exams. Many plans also offer gym memberships and transportation to medical appointments. If you're not sure which plan is best, the benefits might help you choose one over the other.

Consider third-party ratings: Look at the CMS star rating for each plan you consider buying. Plans with higher ratings have better quality coverage and better customer satisfaction. You could also talk with current members to see if they have had a good experience with the plan or company.

Frequently asked questions

What is the best Medicare Advantage plan in Tennessee?

Amerigroup sells the best cheap Medicare Advantage plans in Tennessee. Its plans aren't as highly rated as those from BlueCross BlueShield of Tennessee, but they are much cheaper and still get good reviews. If you want a plan that doesn't have a monthly fee, Aetna is the best choice.

How much does Medicare Advantage cost in Tennessee?

In Tennessee, a Medicare Advantage plan costs an average of $22 per month. Plans range in price from $0 per month to $171 per month. Everyone in Tennessee has access to a plan that doesn't have a monthly cost.

Is an HMO plan or a PPO plan better?

They're both good options, and the right one depends on your needs. If you want the cheapest plan, an HMO is probably the better choice. Because HMOs restrict you to certain doctors, they're usually cheaper. A PPO tends to be more expensive, and it's better if you want to be able to see specialists without a referral, and if you want the flexibility to go to any doctor and still have some coverage. But you can still find PPOs that don't have a monthly cost, like those from Aetna and Amerigroup.

Methodology

ValuePenguin used data from the Centers for Medicare & Medicaid Services (CMS) public use files to compile average Medicare Advantage plan rates for plans with prescription drug coverage. County-level enrollment data and total Tennessee Medicare Advantage enrollment numbers are from the University of Iowa. Employer group plans, Medicare-Medicaid Plans (MMPs), Medical Savings Account (MSA) plans, Program of All-Inclusive Care for the Elderly (PACE) plans, Health Care Prepayment Plans (HCPPs), sanctioned plans and Special Needs Plans (SNPs) were excluded from this review.

The best companies were chosen using an analysis of average rates, CMS star ratings, availability, coverage quality and extra benefits. Other sources include Aetna, Amerigroup and BlueCross BlueShield of Tennessee.

Editorial Note: We are committed to providing accurate content that helps you make informed financial decisions. Our partners have not endorsed or commissioned this content.