Geico DriveEasy Review: Is it Worth it?

Geico DriveEasy isn't the best usage-based discount. It only saves you up to 10%, and you could even see your rates go up.

Find Cheap Auto Insurance Quotes in Your Area

Geico DriveEasy uses an app to track your driving behavior. But you can find a better program elsewhere. Other insurance companies give you a bigger discount and don't raise your rates if you're a risky driver.

Pros and cons

Pros

Good for current Geico customers who already have cheap rates

Cons

Mediocre discount

Rates can go up

Phone use can affect your discount

How does Geico DriveEasy work?

Geico DriveEasy uses an app to track your driving habits and patterns, then gives you a discount of up to 10%.

Although various sources online say the discount can be up to 25%, ValuePenguin confirmed with Geico that 10% is usually the highest discount available. But you might see your rates increase if your DriveEasy data shows you're a risky driver.

The app tracks eight different things as you drive, and uses the data to set a driving score.

- Handheld phone use: This includes making handheld calls or using any apps if you're driving more than six miles per hour.

- Hard braking and acceleration: Stopping and accelerating quickly lowers your driving scores, since it makes you more likely to hit someone.

- Cornering: This is when you take turns too quickly, which could lead to accidents.

- Smoothness: This refers to how consistent your speed is once your car is done accelerating and how long you stay at those speeds.

- Time of day: Driving at night is considered a higher risk and lowers your score.

- Distance driven: The less you drive, the lower your risk of accidents.

- Route regularity: Driving in a familiar area might mean accidents are less likely. If you drive a new route, you might drive differently or pay more attention to a map than the road.

- Weather: Driving during bad weather can make accidents more likely. Rain can make it hard to see, for example, while snow and ice increase the risk of sliding.

To join the DriveEasy program, you have to download the Geico DriveEasy Pro app. The app runs while you drive and gathers information about your driving habits. Geico reviews the data to set your driving score, which then leads to your discount.

DriveEasy continuously monitors your driving, even if you are driving a different car. Because your driving is constantly being reviewed, your discount can change every time you renew your policy, if your driving score changes.

The app might also incorrectly list you as a driver when you're a passenger. If this happens, you can change yourself from "driver" to "passenger" by reviewing your trips in the app. Only the trips that list you as a driver will be used to determine your driving score.

Touching your phone for any reason will lower your Geico DriveEasy score. That includes unlocking it or using GPS. The app also can't tell who is using your phone. Your score will go down even if your passenger uses your phone while you're driving. But hands-free phone use, like calls connected to your car's Bluetooth system, doesn't count against you.

Not all companies punish you for phone use during these discount programs. You might want to consider another company for their usage-based discount if you use your phone often, like when using GPS. Just keep in mind that phone use while driving is dangerous, and in some states, it's illegal.

Geico might also use your DriveEasy data as evidence if you're involved in an accident.

For example, if you slam on the brakes, DriveEasy will ask if you were in an accident. If you were, the app can contact the police or an ambulance, give them your location and start a claim.

Is Geico DriveEasy worth it?

Geico DriveEasy may be worth it for careful drivers who already have Geico insurance.

Geico DriveEasy is worth it if:

You're a current Geico customer

If you're already with Geico and want a lower rate, you could try the DriveEasy program. Most people get a sign-up discount, and then you could lower your rate by up to 10% if you're a good driver.

You're a safe driver

If you know you're a good driver, Geico DriveEasy could be a good option. Geico can raise your rates if your driving habits are risky, so the program is best for people who already have good driving skills.

You're willing to risk higher rates

Even if you think you're a good driver, you might be surprised by the data that Geico collects. You should only sign up for the program if you're willing to risk your rates going up.

Geico DriveEasy is not worth it if:

You want a bigger discount

-

Why?: The most you can save with the Geico DriveEasy program is 10%. Other insurance companies could give you bigger savings.

- Better options: State Farm Drive Safe & Save and Liberty Mutual RightTrack both offer discounts up to 30%.

You use your phone while driving

-

Why?: Geico counts all handheld phone use against you when you're enrolled in DriveEasy. Even if you unlock your phone or touch your screen while using GPS, your driving score will go down.

- Better options: Liberty Mutual RightTrack and Nationwide SmartRide are good options, because neither program tracks your phone use.

You drive often or are often a passenger

-

Why?: Driving often or long distances will lower your DriveEasy discount. And the app is supposed to be able to tell if you're a passenger or driver, but it could make a mistake. You can fix it in the app, but if you don't check the app often, you might get a lower score if you were a passenger when someone else was driving poorly.

- If you drive often, drive long distances or are often a passenger, this type of discount might not be right for you. Because driving more increases your chances of an accident, all usage-based discounts track how often and how far you drive. And most programs also automatically detect if you're a passenger or the driver, which can lead to inaccuracies.

DriveEasy also continuously monitors your driving, which means your discount can go up and down each policy period based on your score. Liberty Mutual, Nationwide and Progressive only track your driving for a set period of time. After the monitoring period ends, your discount is applied and won't change.

Find Cheap Auto Insurance Quotes in Your Area

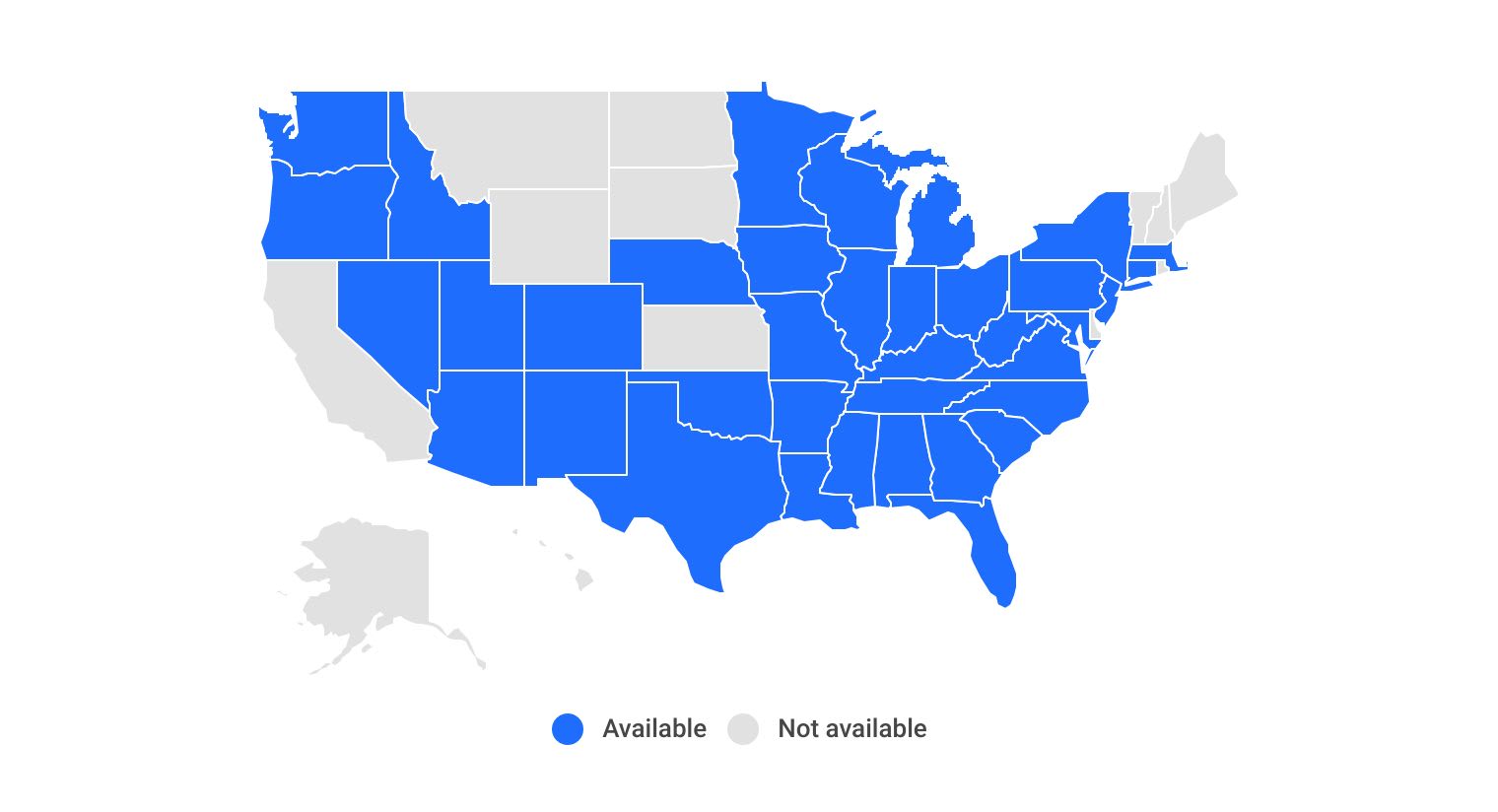

Where is Geico DriveEasy available?

Geico offers DriveEasy in 37 states and Washington, D.C.

While you can buy coverage from Geico in every state, you can only get the DriveEasy program in these areas.

Find Cheap Auto Insurance Quotes in Your Area

Geico DriveEasy availability by state

Frequently asked questions

How much does Geico DriveEasy save?

DriveEasy can save you up to about 10% off your car insurance rate, according to a Geico representative who spoke with ValuePenguin. But the amount you save will depend on how well you drive. If the DriveEasy program flags you as a risky driver, your rates might even go up.

Does Geico DriveEasy track phone usage?

Geico DriveEasy tracks handheld phone use when you're driving. That includes just unlocking your phone, checking a map or putting something into GPS. Hands-free phone use, like calls over your car's Bluetooth, are okay and don't count against your driving score.

How long do I have to use Geico DriveEasy?

DriveEasy continuously monitors your driving habits. That means you'll lose your discount if you stop using the app. Your discount can also change each policy period if your driving score goes up or down.

How do I turn off Geico DriveEasy?

You have to call Geico's customer service line at 800-207-7847 to cancel DriveEasy. But canceling the program could mean you lose your participation discount. And if you've been using DriveEasy for more than 45 days, you'll lose whatever discount was applied to your policy based on your driving.

Methodology

Data regarding the Geico DriveEasy program is from the Geico website and ValuePenguin's discussions with Geico agents. Program info for other insurance companies was gathered from their websites.

Editorial Note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.