Kaiser Permanente Insurance Review: Is it Good?

Kaiser Permanente’s regular health insurance plans are consistently high-rated, making it a good choice if they're available in your area. But, its Medicare Advantage plans are just average.

Find Cheap Health Insurance Quotes in Your Area

Kaiser Permanente is one of the best-rated companies in the country for its regular health insurance. But its Medicare Advantage plan ratings have slipped in the past year.

Kaiser is unique in that it offers both health insurance and it runs its own hospitals. This is great if you want a streamlined experience between health insurance and health care. But Kaiser might not be a good fit if you want flexibility when choosing your treatment or doctor.

Pros and cons

Pros

Great service and coverage

Emphasis on preventive coverage

Runs its own medical offices

Cons

Limited coverage areas

Limited network of doctors

Average Medicare Advantage ratings

Is Kaiser Permanente good?

Kaiser Permanente is considered one of the best health insurance companies in the country.

Kaiser's health insurance plans are highly rated, scoring a near-perfect 4.8 out of 5 rating from HealthCare.gov. The score reflects a high level of coverage quality and customer satisfaction.

However, Kaiser Permanente's Medicare Advantage plans have declined in quality over the past year. Kaiser has an average 3.8 out of 5 overall score, according to the Centers for Medicare and Medicaid (CMS). In addition, it doesn't have a single five-star Medicare Advantage plan for 2024.

While a 3.8 score isn't bad, it's not exceptional. You should shop around and carefully consider all of your options before choosing a Medicare Advantage plan.

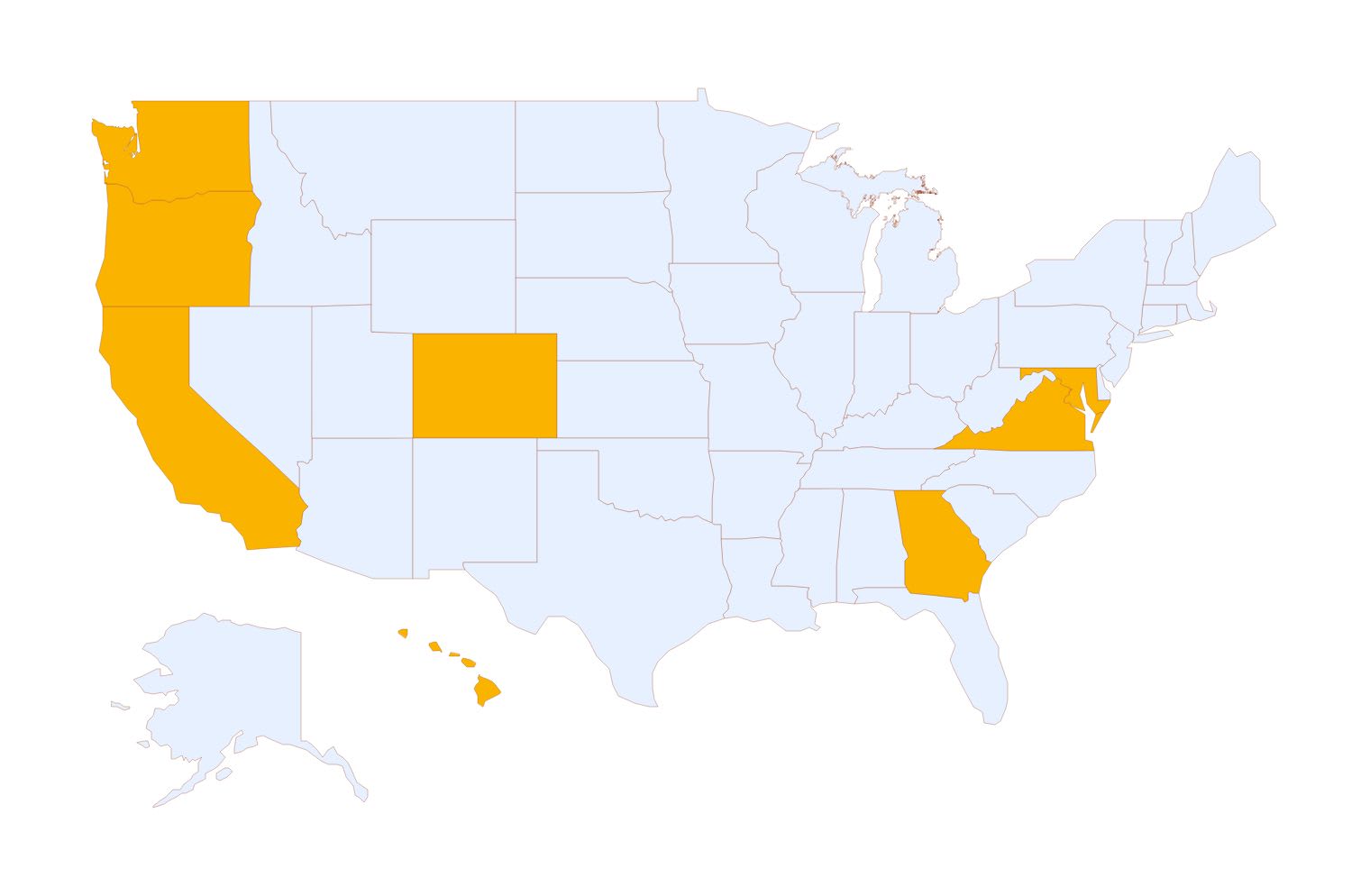

Where is Kaiser Permanente available?

Kaiser Permanente offers health insurance plans in eight states and the District of Columbia. This includes areas on the West Coast, in the mid-Atlantic region and more. If Kaiser isn't available in your state, compare the best-rated health insurance companies.

Kaiser Permanente may only operate in a few states. But, it's still considered a major insurance company because of how many people it covers in those areas. For example, Kaiser is one of the three largest individual health insurance companies in each state that it sells insurance in.

It's also the largest health insurance company by total enrollment in the U.S., despite only selling policies in eight states.

Find Cheap Health Insurance in Your Area

Cost of Kaiser insurance

The cost of Kaiser insurance can range from about $300 to nearly $1,300 per month based on factors such as the coverage level you choose and your age.

Average monthly cost of Kaiser Permanente insurance

Tier | Age 21 | Age 40 | Age 60 |

|---|---|---|---|

| Bronze | $292 | $373 | $772 |

| Silver | $405 | $519 | $1,009 |

| Gold | $392 | $501 | $1,051 |

| Platinum | $463 | $592 | $1,304 |

Keep in mind that these base rates are for people paying full price for health insurance. Health insurance subsidies through the Affordable Care Act (ACA) can help lower your monthly insurance bills. You can also qualify for these health insurance discounts based on your income and family size.

Kaiser health insurance is usually cheaper than other major insurance companies such as Blue Cross Blue Shield.

Find Cheap Health Insurance in Your Area

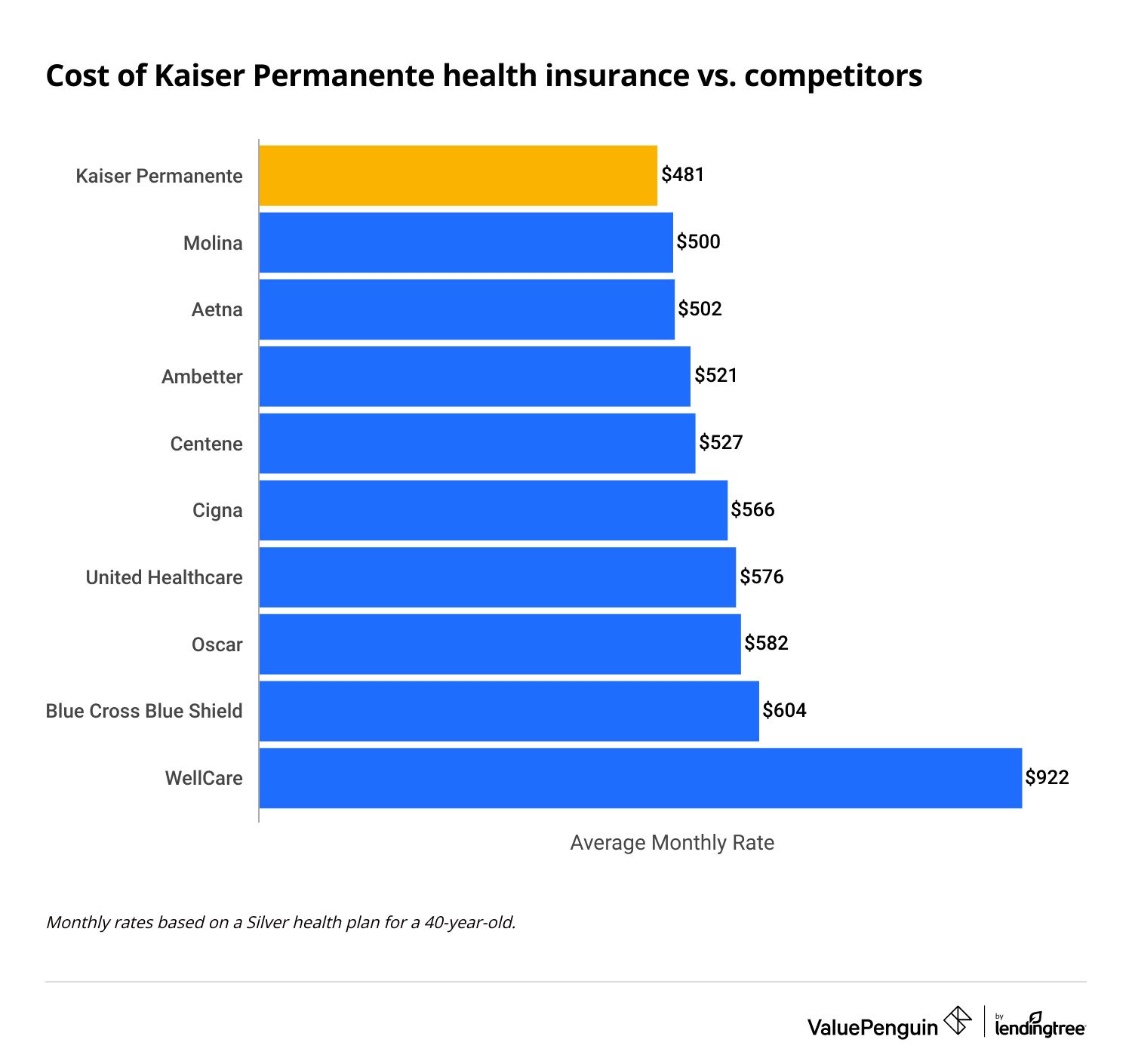

Cost of Kaiser Permanente health insurance vs. competitors

Company | Monthly cost |

|---|---|

| Kaiser Permanente | $481 |

| Molina | $500 |

| Aetna | $502 |

| Ambetter | $521 |

| Centene | $527 |

Average monthly cost of a Silver plan for a 40-year-old.

The cost of Kaiser health insurance also changes by location. For example, a 40-year-old with a Silver plan can expect to pay just $386 per month in Maryland. But, that same person would pay an extra $165 per month for the same coverage if they lived in Washington state.

Kaiser Permanente cost by state

Company | Monthly cost |

|---|---|

| Maryland | $386 |

| Virginia | $406 |

| Colorado | $448 |

| Hawaii | $474 |

| Oregon | $507 |

| Washington, D.C. | $518 |

| California | $523 |

| Georgia | $537 |

| Washington | $551 |

Average cost for a 40-year-old with a Silver plan.

Kaiser health insurance plan options

Kaiser Permanente offers multiple types of health insurance, including individual plans, family plans, Medicare, Medicaid and group health insurance.

Most Kaiser insurance plans are HMO (health maintenance organization) plans which typically offer affordable prices but limit your access to doctors.

This means you need to get all of your non-emergency medical care at one of Kaiser's 618 medical offices and 40 hospitals. HMO plans also require you to select a primary care doctor who can refer you to specialists as needed.

The downside to HMOs is that you may have a difficult time seeing the specialists you need compared to a PPO (preferred provider organization) plan .

The limited network can also be a problem for people who travel regularly. When you're away from home, only urgent care and emergency room services are covered at non-Kaiser hospitals.

But, Kaiser Permanente has a special phone line to help you when you're traveling to another Kaiser service area or outside of the service area.

Individual and family plans

You can buy Kaiser health insurance plans through the Health Insurance Marketplace set up by the Affordable Care Act (also called "Obamacare") or directly from Kaiser. But, buying insurance through the marketplace makes you eligible for health insurance tax credits, which can lower your health insurance costs.

Kaiser Permanente plans include required standard coverages, such as access to free preventive care and screenings, as well as financial protections like an out-of-pocket maximum. Plans are divided into standard metal tiers of Bronze, Silver, Gold and Platinum. Kaiser's plans are also sorted into three insurance categories, so you can choose a Bronze Deductible plan, a Gold Copayment plan or another combination.

- Health savings account (HSA) plans: These high-deductible plans are the cheapest plans offered by Kaiser. They allow you to set up a health savings account so you can avoid paying taxes on the money you'll use to pay for doctor appointments and other health care services.

- Deductible plans: These plans work like traditional insurance where you'll pay for most health services yourself until your spending reaches the deductible amount . Then, you'll pay a fixed percentage of your remaining bill, called acoinsurance rate.

- Copayment plans: These Gold and Platinum tier plans have high monthly rates. But, they have no deductible. These policies can help you save money if you expect high medical costs because you'll only pay a low fixed fee, called a copayment, for covered services.

Medicare

Kaiser Permanente also offers Medicare plans, which you can buy either directly from the company or through Medicare.gov.

Plan options:

- Medicare Advantage (Medicare Part C) plans offer extra coverage compared to what you'd get with regular Medicare, adding more cost-saving benefits and prescription drug benefits. These bundled plans can streamline your health coverage. Kaiser has consistently ranked as one of the best Medicare Advantage companies.

- Medicare Advantage Plus plans are how Kaiser classifies its Part C plans that also include coverage for dental care, hearing aids and eyewear.

- Prescription coverage is only available as a part of a bundled Medicare Advantage plan. Stand-alone drug coverage plans (Medicare Part D) are not offered.

Kaiser does not offer Medicare Supplement (Medigap) plans, and those who are looking for these plans can choose from the best Medicare Supplement companies, which include UnitedHealthcare and Aetna.

Medicaid and programs for those with low incomes

Kaiser Permanente also participates in Medicaid programs. For those who qualify for low-income health insurance, the plan issued by your government agency may be through Kaiser.

In addition, Kaiser also offers a Charitable Health Coverage program that offers access to care for those who are not eligible for public or private health coverage.

There's also a Medical Financial Assistance program that offers free or reduced health care services for people who earn a low income.

Employer and group insurance

For group insurance that you get through your employer, Kaiser may offer a wider variety of plan options than what's available for individuals. For example, some locations have PPO plans available. These plans let you visit doctors who aren't in the Kaiser network.

Kaiser Permanente overage, member resources and unique features

Kaiser Permanente's health coverage stands out in two ways:

- Its integration of health insurance with health care makes it easier for you to track costs and manage claims.

- The strong preventive care program includes access to screenings, health resources, lifestyle programs and health classes.

Depending on your plan, Kaiser's member services may include:

- Women's health services

- Mental health

- Addiction and recovery

- Chiropractic care

- Wellness coaching

- Prescription delivery

- Dental care (add-on)

- Vision care (add-on)

The company's great online tools also stands out from other companies. Plans include:

- Telehealth over phone, video or email

- Online access to health records including test results, doctor's notes and vaccination records

- A cost lookup tool

- The ability to schedule or cancel appointments

- Health insurance management including tracking your deductible

Plus, there are fitness resources including discounted gym memberships, health calculators and discounted massage therapy.

Kaiser Permanente reviews and complaints

Kaiser Permanente gets top-tier scores for coverage and customer service.

How satisfied are existing customers?

Kaiser Permanente ranked first in a recent JD Power survey for health insurance customer satisfaction. It was named the best health insurance company in all of its locations where plans were ranked.

In a separate J.D. Power study of Medicare Advantage customers, Kaiser ranked as the third-best company in California. This study only looked at plans in California, New York, Florida, Texas and Pennsylvania.

How are Kaiser's plans ranked?

In terms of overall plan rankings, Kaiser Permanente is very highly rated for its regular health insurance plans, with nearly all plans having 5 stars on HealthCare.gov. But, its Medicare Advantage plans score a more modest 3.8 out of 5 stars on average. While this is still a good score, it's not exceptional and in many areas, you'll have access to higher-quality plans.

Does Kaiser Permanente get many complaints?

Kaiser gets almost three times as many complaints as an average health insurance company its size, according to the National Association of Insurance Commissioners (NAIC). Kaiser has historically gotten a low number of complaints relative to its size.

The most common complaints are poor customer service and poor availability when setting appointments. While this sudden uptick in the number of complaints should cause you to proceed with caution, it's important to remember that its high ratings from HealthCare.gov and JD Power represent a large number of satisfied Kaiser customers.

What are the reviews of Kaiser Permanente's doctors and medical care?

In California, Kaiser Permanente earned an average of five stars out of five for the quality of medical care, according to the state report card. But Kaiser only earned two stars for the overall patient experience.

This is low, but it matches the statewide average for all health insurance companies. This shows that patients are often not satisfied with their experience with any insurance company.

More than 75,000 Kaiser staffers went on strike in October of 2023 over low wages and worker shortages. Although the strike is over, it may take a while before staffing levels ramp up to adequate levels.

What do Medicare Advantage policyholders say?

Survey data collected by Medicare shows that Kaiser's Medicare Advantage customers rate their plans as being average to somewhat above average. Customers generally give the company high ratings for preventive services and medical care.

But, the company scores quite low on its drug plan and on reviewing appeals decisions. There are also state-level differences, with Washington state standing out as having a lot more dissatisfied customers compared to other states.

Frequently asked questions

Is Kaiser a good insurance company?

Yes, Kaiser Permanente is a good health insurance company, earning top scores for its regular health insurance plans in areas such as customer satisfaction, preventive care and overall experience.

But, its Medicare Advantage plans are just above average and not always your best option.

Does Kaiser have HMO plans or PPO plans?

Most Kaiser health insurance plans are HMOs, meaning you'll generally have lower monthly costs, but your health coverage is limited to in-network doctors and facilities. Some PPO plans may be available, but these are generally not as well-rated as Kaiser's HMO plans.

How much is Kaiser insurance per month?

The average monthly cost of insurance from Kaiser Permanente will heavily depend on your state of residence. For example, Kaiser rates for health insurance range from $386 in Maryland to $551 in Washington.

For those getting insurance on the marketplace, the amount you pay may be reduced because of health insurance subsidies.

Does Kaiser offer "Obamacare" insurance plans?

Yes, you can buy Kaiser Permanente insurance from the "Obamacare" Health Insurance Marketplace. You can only buy a Kaiser plan if you live in California, Oregon, Washington, Colorado, Maryland, Virginia, Georgia, Hawaii or Washington, D.C.

Can I add dental to my Kaiser health insurance?

Yes, you can add dental insurance to your Kaiser medical insurance during open enrollment. Depending on your location and situation, you can either sign up directly through Kaiser Permanente or by choosing a dental plan listed on the marketplace.

Methodology and sources

Cost comparisons use data from 2024 public use files from the Centers for Medicare and Medicaid Services (CMS). Calculations are based on company, location, age and metal tier. Ranking data is from separate CMS public use files.

Other sources include health insurance company marketing material, HealthCare.gov, Medicare.gov, J.D. Power, the Kaiser Family Foundation and the State of California's Office of the Patient Advocate.

The National Association of Insurance Commissioners (NAIC) average complaint score is based on a weighted average of all subsidiaries based on total premiums.

Editorial note: The content of this article is based on the author's opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.